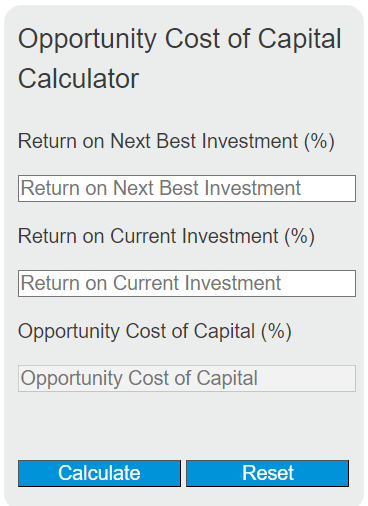

Enter the return on the next best investment and the return on the current investment into the calculator to determine the opportunity cost of capital. This calculator helps to evaluate the potential benefits one misses out on when choosing one investment over another.

Opportunity Cost of Capital Formula

The following formula is used to calculate the opportunity cost of capital:

OCC = RNB - RC

Variables:

- OCC is the opportunity cost of capital (%)

- RNB is the return on the next best investment (%)

- RC is the return on the current investment (%)

To calculate the opportunity cost of capital, subtract the return on the current investment from the return on the next best investment.

What is Opportunity Cost of Capital?

Opportunity cost of capital is the difference in return between a chosen investment and the next best alternative that is not chosen. It represents the benefits an investor misses out on when they choose one investment over another. This concept is crucial in finance as it helps investors to measure the potential missed opportunities and make more informed decisions.

How to Calculate Opportunity Cost of Capital?

The following steps outline how to calculate the Opportunity Cost of Capital.

- First, determine the return on the next best investment (RNB) in percentage.

- Next, determine the return on the current investment (RC) in percentage.

- Use the formula from above = OCC = RNB – RC.

- Finally, calculate the Opportunity Cost of Capital (OCC) in percentage.

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem:

Use the following variables as an example problem to test your knowledge.

Return on the next best investment (RNB) = 8%

Return on the current investment (RC) = 5%