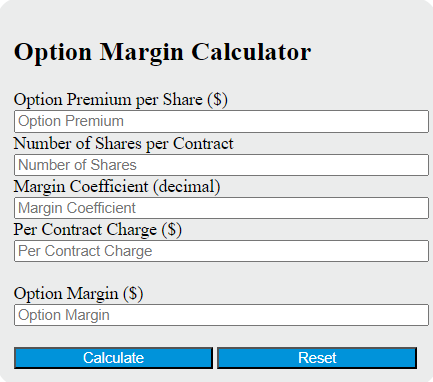

Enter the option premium per share, number of shares per contract, margin coefficient, and per contract charge into the calculator to determine the option margin.

Option Margin Formula

The following formula is used to calculate the option margin.

OM = (OP * NS * MC) + (NS * PC)

Variables:

- OM is the option margin ($)

- OP is the option premium per share ($)

- NS is the number of shares per contract

- MC is the margin coefficient (decimal)

- PC is the per contract charge ($)

To calculate the option margin, multiply the option premium per share by the number of shares per contract, then multiply the result by the margin coefficient. Add the product of the number of shares per contract and the per contract charge to the previous result. The sum is the option margin.

What is an Option Margin?

Option Margin is a type of collateral that the holder of an options contract is required to deposit with their broker or trading platform to cover the risk of default. It is essentially a deposit on the maximum potential loss of the options contract. The amount of the margin varies depending on the type of option, the underlying asset, and market conditions. It is designed to protect both the broker and the other party in the options contract from the risk of the holder not being able to fulfill their obligations.

How to Calculate Option Margin?

The following steps outline how to calculate the Option Margin.

- First, determine the option premium per share ($).

- Next, determine the number of shares per contract.

- Next, determine the margin coefficient (decimal).

- Next, determine the per contract charge ($).

- Next, gather the formula from above = OM = (OP * NS * MC) + (NS * PC).

- Finally, calculate the Option Margin.

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem :

Use the following variables as an example problem to test your knowledge.

option premium per share ($) = 10

number of shares per contract = 100

margin coefficient (decimal) = 0.5

per contract charge ($) = 5