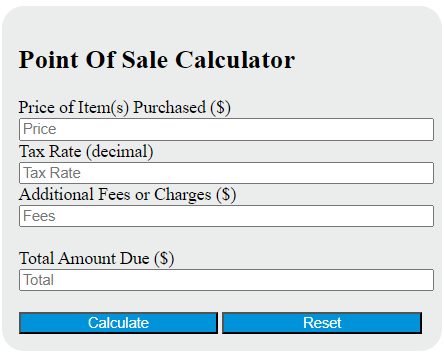

Enter the price of the item(s), tax rate, and any additional fees or charges into the calculator to determine the total amount due.

Point Of Sale Formula

The following formula is used to calculate the total amount due in a Point Of Sale (POS) system.

T = P + (P * T) + F

Variables:

- T is the total amount due ($)

- P is the price of the item(s) purchased ($)

- T is the tax rate (decimal)

- F is any additional fees or charges ($)

To calculate the total amount due, multiply the price of the item(s) purchased by the tax rate and add this to the original price. Then, add any additional fees or charges.

How to Calculate Point Of Sale?

The following steps outline how to calculate the total amount due for a Point Of Sale using the formula T = P + (P * T) + F.

- First, determine the price of the item(s) purchased ($).

- Next, determine the tax rate (decimal).

- Next, determine any additional fees or charges ($).

- Next, insert the values into the formula T = P + (P * T) + F.

- Finally, calculate the total amount due (T).

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem:

Use the following variables as an example problem to test your knowledge.

price of the item(s) purchased ($) = 50

tax rate (decimal) = 0.08

any additional fees or charges ($) = 5