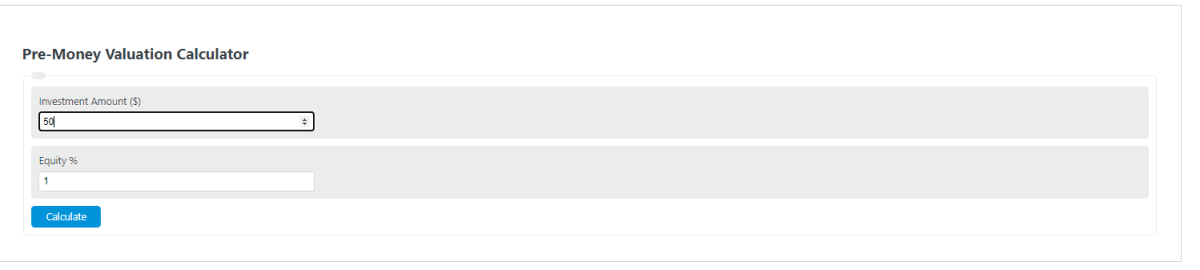

Enter the invested dollar amount and the percentage of equity an investor receives into the calculator to determine the pre-money valuation.

- SaaS Lifetime Value Calculator

- Run Rate Calculator

- Burn Rate Calculator

- Total Addressable Market Calculator

- Startup Valuation Calculator

- Client Money Calculator

- Cost Per Dollar Raised Calculator

Pre-Money Valuation Formula

The following formula is used to calculate a pre-money valuation.

PreMV = (I / (E/100)) - I

- Where PreMV is the pre-money valuation ($)

- I is the investment amount ($)

- E is the equity received for the investment (%)

To calculate the pre-money valuation, subtract the equity from the total investment amount.

Pre-Money Valuation Definition

A pre-money valuation is defined as the value of a company, not including any of the latest rounds of funding. In other words, the worth of the company before it receives investments or funding.

Example Problem

How to calculate a pre-money valuation?

First, determine the total investment someone is looking to put into the company. For this example problem, we are looking at a very early-stage tech company that has not received any funding. An investor comes in and would like to invest $2,000,000 into the company.

Next, determine the equity percentage the investor seeks to receive for the investment. In this case, the investor would like a 20% stake for their funding.

Finally, calculate the pre-money valuation using the formula above:

PreMV = (I / (E/100)) – I

= (2,000,000/(20/100)) – 2,000,000

= $8,000,000.00

From the information above, we can also calculate the post-money valuation. That is done using the formula:

PostMV = I/(E/100)

= $10,000,000.00

FAQ

What is the difference between pre-money and post-money valuation?

Pre-money valuation refers to the value of a company before receiving any new investments, while post-money valuation includes the value of the company immediately after receiving those investments. Essentially, post-money valuation equals the pre-money valuation plus the amount of the new investment.

Why is pre-money valuation important for startups?

Pre-money valuation is crucial for startups as it determines the equity share that has to be given away to investors in exchange for their funding. It directly impacts the ownership percentage of the founders and the valuation at which new investors come in. A higher pre-money valuation means founders can retain more equity in their company after raising capital.

How can a startup increase its pre-money valuation?

A startup can increase its pre-money valuation by demonstrating strong growth potential, having a unique value proposition, expanding its customer base, improving its financial performance, and having a solid business plan. Additionally, strategic partnerships and intellectual property can also significantly boost a startup’s pre-money valuation.