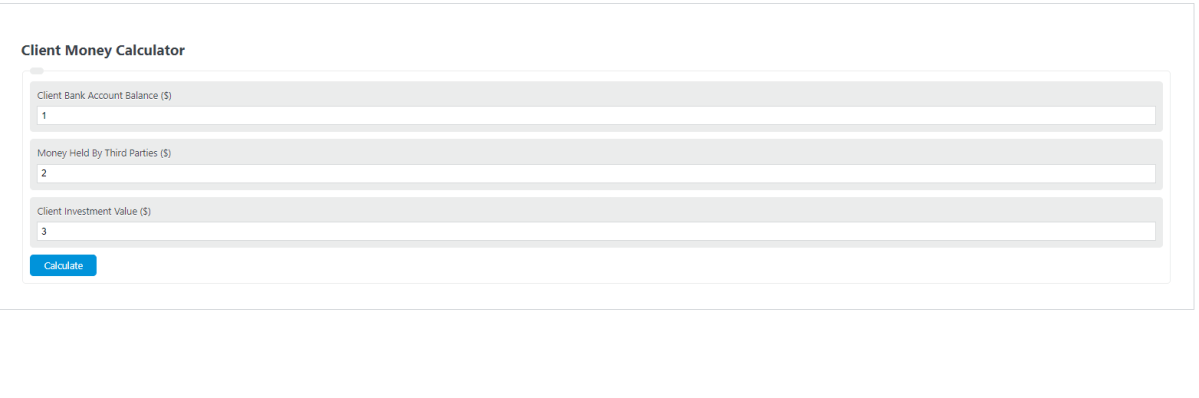

Enter the firm’s bank account balance, the value of client money held at third parties, and the designated investments into the calculator to determine the client’s money.

Client Money Formula

The following equation is used to calculate the Client’s Money.

CM = a + b + c

- Where CM is the total client money ($)

- a is the firm’s client bank account balance at the close of the business on the previous day

- b is the value of the client money held at third parties

- c is the value of the designated investment

To calculate the client’s money, sum the client’s bank account balance, third-party value, and investment values.

What is Client Money?

Definition:

Client money is a term used to describe the total monetary value of a client’s bank account of the previous day plus the value of money held at third parties plus the value of client investments.

How to Calculate Client Money?

Example Problem:

The following example outlines the steps and information needed to calculate Client Money.

First, determine the balances of the account at the close of the previous day. In this example, the balance is found to be $200,000.00.

Next, determine the money held by third parties. In this case, the value held by third parties is $100,000.00.

Next, determine the client investments value. This is calculated to be $150,000.00.

Finally, calculate the client money using the formula above:

CM = a + b + c

CM = 200,000 + 100,000 + 150,000

CM = $450,000.00

FAQ

What are the common sources of client money?

Common sources of client money include funds deposited by clients into their accounts, payments received from third parties on behalf of clients, and proceeds from the sale of client investments.

How can firms ensure compliance with regulations governing client money?

Firms can ensure compliance by maintaining accurate and separate records for client funds, performing regular reconciliations of client money accounts, and adhering to strict protocols for handling and transferring client funds.

What happens to client money if a firm goes bankrupt?

In the event of a firm’s bankruptcy, client money is typically protected and must be returned to clients or transferred to another regulated entity, depending on the regulatory framework and the specific arrangements made by the firm for safeguarding client funds.