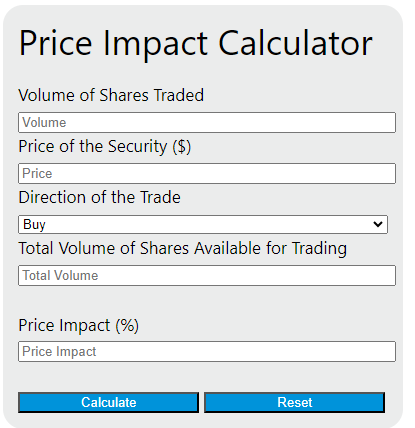

Enter the volume of shares traded, price of the security, direction of the trade, and total volume of shares available for trading into the calculator to determine the Price Impact.

Price Impact Formula

The following formula can be used to calculate the Price Impact:

PI = (V * P * D) / T

Variables:

- PI is the price Impact (%)

- V is the volume of shares traded

- P is the price of the security ($)

- D is the direction of the trade (1 for buy, -1 for sell)

- T is the total volume of shares available for trading

To calculate the Price Impact, multiply the volume of shares traded by the price of the security and the direction of the trade. Divide this result by the total volume of shares available for trading. The result will give you the Price Impact in percentage. A positive result indicates an upward price impact (price increase), while a negative result indicates a downward price impact (price decrease).

What is a Price Impact?

Price impact refers to the effect that large trades or high trading volumes have on the price of a security. When a large number of shares are bought or sold, it can significantly move the price up or down. This is because the increased demand or supply can outweigh the current available supply or demand. Price impact is a crucial consideration for large investors and traders as their trades can influence the market price, potentially leading to less favorable execution prices.

How to Calculate Price Impact?

The following steps outline how to calculate the Price Impact.

- First, determine the volume of shares traded (V).

- Next, determine the price of the security (P).

- Next, determine the direction of the trade (D). Use 1 for buy and -1 for sell.

- Finally, determine the total volume of shares available for trading (T).

- After gathering all the variables, use the formula PI = (V * P * D) / T to calculate the Price Impact.

Example Problem:

Use the following variables as an example problem to test your knowledge.

Volume of shares traded (V) = 500

Price of the security (P) = $10

Direction of the trade (D) = 1 (buy)

Total volume of shares available for trading (T) = 1000