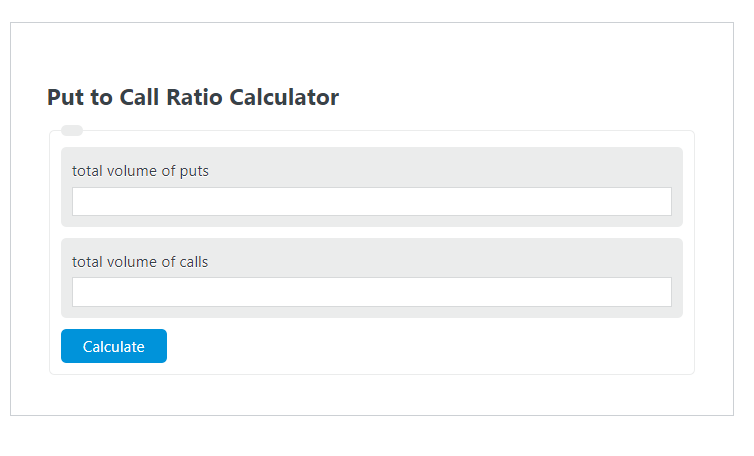

Enter the total volume of puts and the total volume of calls into the Put to Call Ratio Calculator. The calculator will evaluate and display the Put to Call Ratio.

- All Ratio Calculators

- Option Delta Calculator

- Return on Options Calculator

- Butterfly Spread Profit Calculator

Put to Call Ratio Formula

The following formula is used to calculate the Put to Call Ratio.

PCR = P /C

- Where PCR is the Put to Call Ratio ( )

- P is the total volume of puts

- C is the total volume of calls

To calculate the put-to-call ratio, divide the volume of puts by the volume of calls.

How to Calculate Put to Call Ratio?

The following example problems outline how to calculate Put to Call Ratio.

Example Problem #1:

- First, determine the total volume of puts.

- The total volume of puts is given as: 5,000.

- Next, determine the total volume of calls.

- The total volume of calls is provided as: 10,000.

- Finally, calculate the Put to Call Ratio using the equation above:

PCR = #P / #C

The values given above are inserted into the equation below and the solution is calculated:

PCR = 5,000 / 10,000 = .50

FAQ

What is the significance of the Put to Call Ratio in the stock market?

The Put to Call Ratio is a popular indicator used by investors to gauge market sentiment. A high ratio suggests that investors are bearish or expecting the market to decline, as it indicates a higher volume of put options being traded compared to call options. Conversely, a low ratio suggests bullish sentiment, indicating that investors are expecting the market to rise.

How can investors use the Put to Call Ratio for making investment decisions?

Investors can use the Put to Call Ratio as a contrarian indicator to help identify potential reversals in the market. For example, an extremely high Put to Call Ratio might suggest that the market is overly pessimistic and could be poised for a rebound. Similarly, an extremely low ratio could indicate over-optimism, suggesting a potential market pullback. However, it’s important for investors to use this indicator in conjunction with other analyses and market indicators.

Are there any limitations to using the Put to Call Ratio as an investment tool?

Yes, there are limitations. The Put to Call Ratio should not be used in isolation as it can sometimes give false signals. Market conditions, news, and other factors can influence the ratio’s effectiveness. Additionally, the ratio can be skewed by large trades that may not reflect broader market sentiment. Therefore, it’s advisable for investors to consider multiple factors and indicators when making investment decisions.