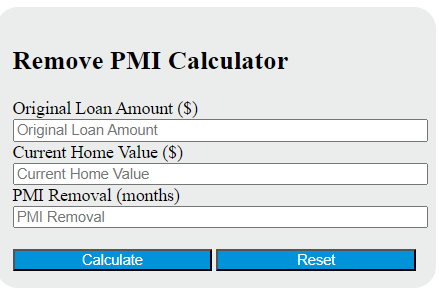

Enter the original loan amount and current home value into the calculator to determine the point at which PMI can be removed. This calculator can also evaluate any of the variables given the others are known.

- Mcc (Mortgage Credit Certificate) Calculator

- Mortgage Service Ratio Calculator

- Mortgage to Income Ratio Calculator

Remove Pmi Formula

The following formula is used to calculate when you can remove PMI (Private Mortgage Insurance).

PMI Removal = (Original Loan* 0.80) / Current Home Value

Variables:

- PMI Removal is the point at which PMI can be removed (in months)

- Original Loan Amount is the initial amount borrowed for the mortgage ($)

- Current Home Value is the current market value of the home ($)

To calculate when you can remove PMI, multiply the original loan amount by 0.80. Then divide this result by the current home value. The result is the point at which PMI can be removed, expressed in months. Once the loan-to-value ratio reaches 80% or less, PMI can typically be removed.

What is a Remove Pmi?

Remove PMI refers to the process of eliminating Private Mortgage Insurance (PMI) from a mortgage loan. PMI is a type of insurance that lenders require from homebuyers who make a down payment that is less than 20% of the home’s value. It protects the lender if the borrower defaults on the loan. However, once the borrower has built up enough equity in the property (usually 20%), they can request to have the PMI removed, thus reducing their monthly mortgage payments.

How to Calculate Remove Pmi?

The following steps outline how to calculate the PMI Removal.

- First, determine the Original Loan Amount ($).

- Next, determine the Current Home Value ($).

- Next, gather the formula from above = PMI Removal = (Original Loan Amount * 0.80) / Current Home Value.

- Finally, calculate the PMI Removal.

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem :

Use the following variables as an example problem to test your knowledge.

Original Loan Amount ($) = 200,000

Current Home Value ($) = 250,000