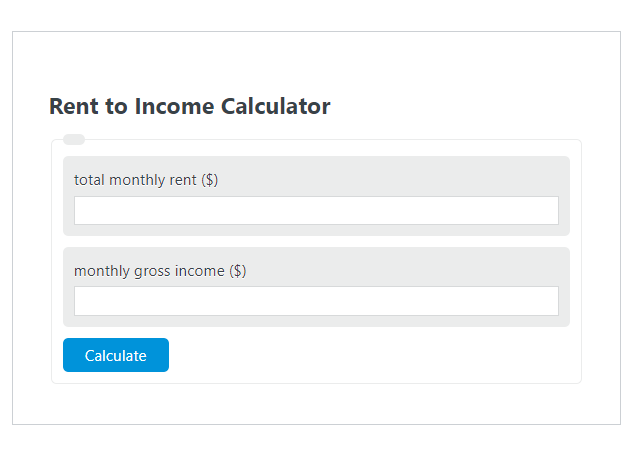

Enter the total monthly rent ($) and the monthly gross income ($) into the Rent to Income Ratio Calculator. The calculator will evaluate and display the Rent to Income Ratio.

- All Ratio Calculators

- Income Rent Ratio Calculator

- Percentage of Income For Rent Calculator

- Simple Ratio Calculator

Rent to Income Ratio Formula

The following formula is used to calculate the Rent to Income Ratio.

RIR = R / I

- Where RIR is the Rent to Income Ratio (rent:income)

- R is the total monthly rent ($)

- I is the monthly gross income ($)

To calculate the rent-to-income ratio, divide the total monthly rent by the monthly gross income.

How to Calculate Rent to Income Ratio?

The following example problems outline how to calculate Rent to Income Ratio.

Example Problem #1:

- First, determine the total monthly rent ($).

- The total monthly rent ($) is given as: 3,000.

- Next, determine the monthly gross income ($).

- The monthly gross income ($) is provided as: 7,000.

- Finally, calculate the Rent to Income Ratio using the equation above:

RIR = R / I

The values given above are inserted into the equation below and the solution is calculated:

RIR = 3,000 / 7,000 = .428:1 (rent:income)

FAQ

What is a good Rent to Income Ratio?

A commonly recommended Rent to Income Ratio is 30% or less. This means that the monthly rent should not exceed 30% of your gross monthly income. Ratios higher than this are often considered financially burdensome.

Why is the Rent to Income Ratio important?

The Rent to Income Ratio is a crucial metric for both renters and landlords. For renters, it helps in budgeting and ensuring that housing costs are manageable relative to income. For landlords, it’s a measure to assess the financial reliability of potential tenants.

Can the Rent to Income Ratio affect my ability to rent an apartment?

Yes, many landlords and property management companies use the Rent to Income Ratio as a criterion for tenant selection. A ratio that is too high can indicate to landlords that the rent might be unaffordable for the applicant, potentially affecting their decision.