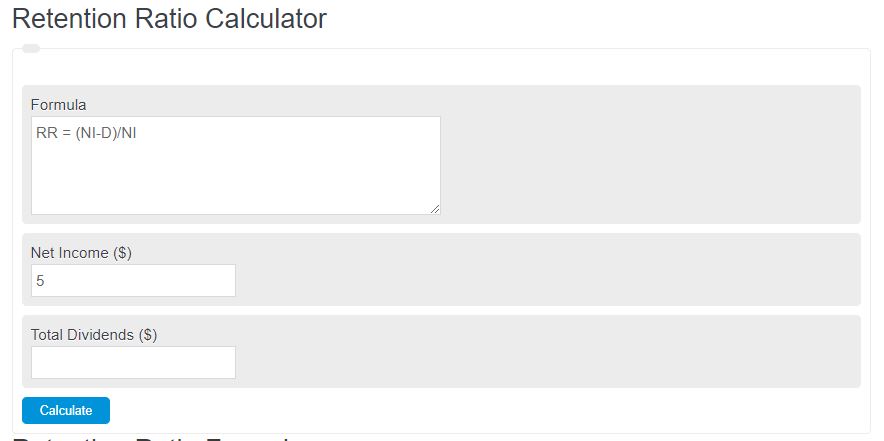

Enter the net income and dividends into the calculator to determine the retention ratio of an asset or business.

- Internal Growth Rate Calculator

- Dividend Payout Ratio Calculator

- Net Cash Flow Calculator

- Net Sales Revenue Calculator

Retention Ratio Formula

The following equation can be used to calculate the retention ratio.

RR = (NI-D)/NI

- Where RR is the retention ratio

- NI is the net income

- D is the dividends

Retention Ratio Definition

A retention ratio refers to the proportion of a company’s earnings that are retained and reinvested into the business rather than being paid out as dividends to shareholders.

This ratio provides insight into how much of the profits a company generates are being plowed back into the business for growth and expansion.

The retention ratio is crucial because it directly impacts a company’s ability to fund its future growth and generate higher returns for its shareholders.

When a company retains a larger portion of its earnings, it has more financial resources available to invest in research and development, acquire new assets, expand operations, or reduce debt. By doing so, the company strengthens its competitive position in the market and enhances its long-term profitability potential.

A high retention ratio indicates that the company’s management has confidence in the firm’s ability to generate higher future earnings.

On the other hand, a low retention ratio suggests that the company may lack growth prospects or face limitations in generating higher returns. It could indicate that the company prefers to distribute its profits to shareholders through dividends, which may be more appealing to income-seeking investors. However, a consistently low retention ratio could hinder the company’s ability to compete and expand in the long run.

Retention Ratio Example

How to calculate a retention ratio?

- First, determine the net income.

Calculate the net income generated by the investment.

- Next, determine the dividends.

Calculate the dividends paid out by the investment.

- Finally, calculate the retention ratio.

Using the equation above, calculate the retention ratio.

FAQ

What factors can influence a company’s retention ratio?

A company’s retention ratio can be influenced by its profitability, investment opportunities, stage in the business lifecycle, industry standards, and shareholder expectations. Companies with high growth prospects often have higher retention ratios as they reinvest earnings back into the business.

How can investors interpret the retention ratio?

Investors can view the retention ratio as an indicator of a company’s growth potential and management’s confidence in future earnings. A high retention ratio suggests that the company is reinvesting a significant portion of its earnings into the business, potentially leading to higher future returns. Conversely, a low retention ratio might indicate that the company is returning more money to shareholders, possibly due to a lack of profitable reinvestment opportunities.

Can a high retention ratio be viewed negatively?

While a high retention ratio is generally seen as a positive indicator of a company’s reinvestment in growth, it can also be viewed negatively if the reinvested earnings do not generate acceptable returns. This might suggest inefficient use of retained earnings or a lack of profitable investment opportunities.

How does the retention ratio impact a company’s financial strategy?

The retention ratio directly impacts a company’s financial strategy by determining how much of its earnings are available for reinvestment in the business versus distribution to shareholders. Companies with higher retention ratios might focus on expanding operations, developing new products, or pursuing acquisitions, while those with lower ratios might prioritize dividend payments or share buybacks to return value to shareholders.