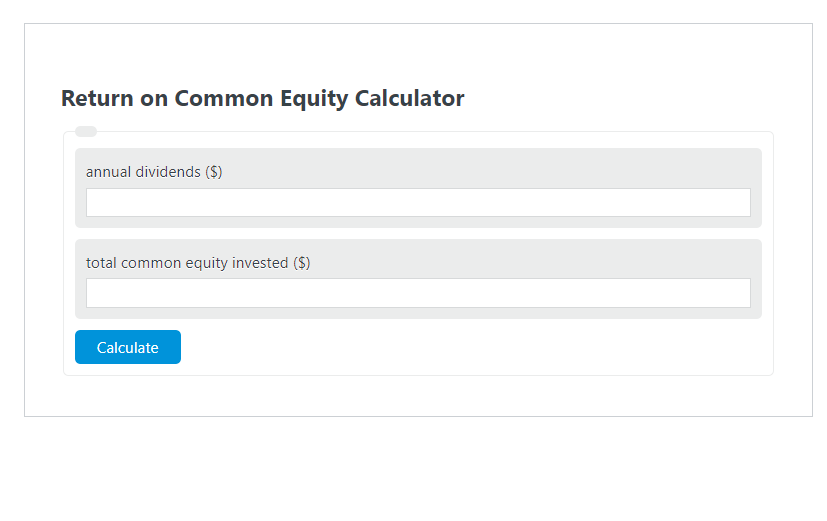

Enter the annual dividends ($) and the total common equity invested ($) into the Return on Common Equity Calculator. The calculator will evaluate and display the Return on Common Equity.

- Return on “X” Calculators

- Return on CD Calculator

- Return on REIT Calculator

- Return on Margin Calculator

Return on Common Equity Formula

The following formula is used to calculate the Return on Common Equity.

ROCE = AD / EI *100

- Where ROCE is the Return on Common Equity (%)

- AD is the annual dividends ($)

- EI is the total common equity invested ($)

How to Calculate Return on Common Equity?

The following example problems outline how to calculate Return on Common Equity.

Example Problem #1:

- First, determine the annual dividends ($).

- The annual dividends ($) is given as: 165.

- Next, determine the total common equity invested ($).

- The total common equity invested ($) is provided as: 2000.

- Finally, calculate the Return on Common Equity using the equation above:

ROCE = AD / EI *100

The values given above are inserted into the equation below and the solution is calculated:

ROCE = 165 / 2000 *100 = 8.25 (%)

FAQ

What is Return on Common Equity (ROCE) and why is it important?

ROCE is a financial ratio that measures the amount of profit a company generates from its common equity investments. It is important because it helps investors understand how effectively a company is using its equity to generate profits, providing insight into the company’s financial health and performance.

How can the ROCE formula be applied in real-world scenarios?

The ROCE formula can be applied in various real-world scenarios, such as evaluating the performance of investment portfolios, analyzing the profitability of companies before making investment decisions, and comparing the financial health of different companies within the same industry.

What are some limitations of using ROCE as a performance metric?

While ROCE is a useful indicator of financial performance, it has limitations. It does not account for debt, so companies with significant leverage may appear more profitable than they actually are. Additionally, ROCE can be influenced by non-operational factors such as tax rates and accounting practices, which may not accurately reflect the operational efficiency of a company.