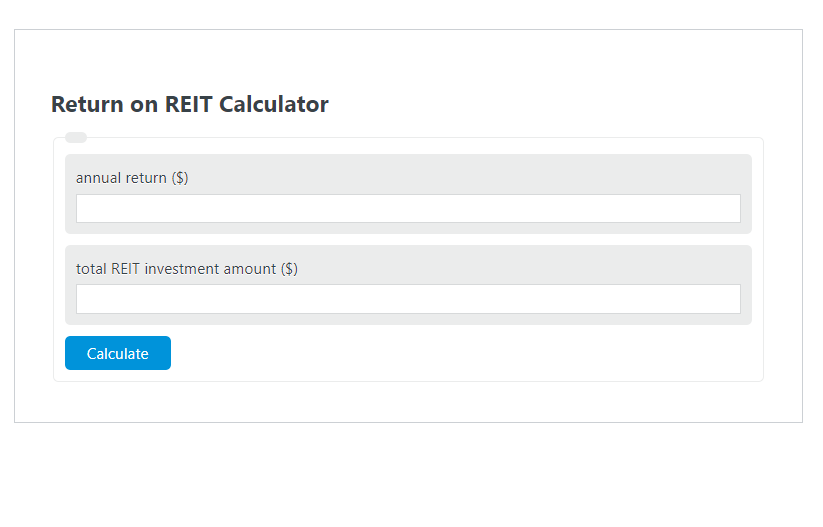

Enter the annual return ($) and the total REIT investment amount ($) into the Return on REIT Calculator. The calculator will evaluate and display the Return on REIT.

- Return on “X” Calculators

- Return on Margin Calculator

- Return on Stocks Calculator

- Return on Rent Calculator

Return on REIT Formula

The following formula is used to calculate the Return on REIT.

ROReit = AR / I * 100

- Where ROReit is the Return on REIT (%)

- AR is the annual return ($)

- I is the total REIT investment amount ($)

How to Calculate Return on REIT?

The following example problems outline how to calculate Return on REIT.

Example Problem #1:

- First, determine the annual return ($).

- The annual return ($) is given as: 5,000.

- Next, determine the total REIT investment amount ($).

- The total REIT investment amount ($) is provided as: 31,000.

- Finally, calculate the Return on REIT using the equation above:

ROReit = AR / I * 100

The values given above are inserted into the equation below and the solution is calculated:

ROReit = 5,000 / 31,000 * 100 = 16.129 (%)

FAQ

What is a REIT?

REIT stands for Real Estate Investment Trust. It is a company that owns, operates, or finances income-producing real estate. REITs provide a way for individual investors to earn a share of the income produced through commercial real estate ownership without actually having to buy, manage, or finance any properties themselves.

Why invest in REITs?

Investing in REITs offers several benefits including the potential for high dividend yields, diversification, and liquidity. REITs are required by law to distribute at least 90% of their taxable income to shareholders annually in the form of dividends, which can provide a steady income stream for investors. Additionally, because REITs are traded on major stock exchanges, they offer the liquidity that direct real estate investments do not.

How does the Return on REIT calculation differ from other investment return calculations?

The Return on REIT calculation specifically measures the performance of Real Estate Investment Trusts by dividing the annual return by the total investment amount in the REIT, then multiplying by 100 to express it as a percentage. This differs from other investment return calculations, such as Return on Investment (ROI) or Return on Equity (ROE), which may not account for the unique structure and tax considerations of REITs. The formula focuses on the income generated from real estate investments relative to the amount invested, highlighting the efficiency and profitability of the REIT investment.