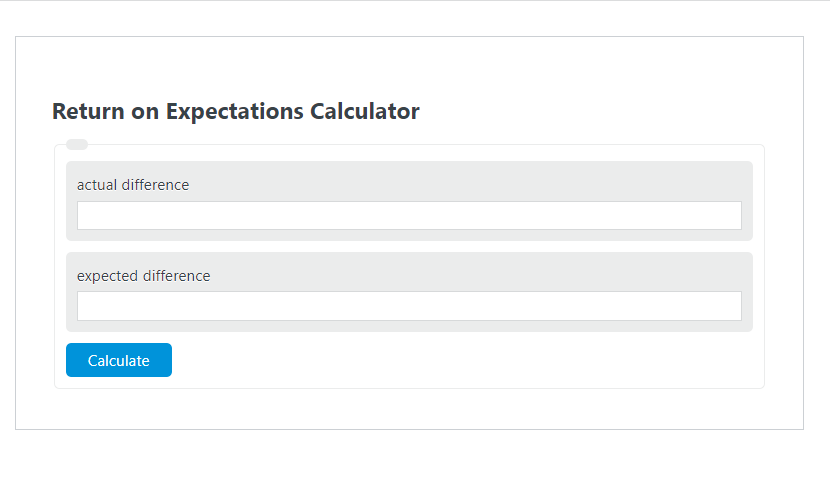

Enter the actual difference and the expected difference into the Return on Expectations Calculator. The calculator will evaluate and display the Return on Expectations.

- Return on “X” Calculators

- Return on Business Calculator

- Return on Labor Calculator

- Return on Experience Calculator

Return on Expectations Formula

The following formula is used to calculate the Return on Expectations.

ROEx = AD / ED *100

- Where ROEx is the Return on Expectations (%)

- AD is the actual difference

- ED is the expected difference

To calculate the return on expectations, divide the actual difference by the expected difference, then multiply by 100.

How to Calculate Return on Expectations?

The following example problems outline how to calculate Return on Expectations.

Example Problem #1:

- First, determine the actual difference.

- The actual difference is given as: 45.

- Next, determine the expected difference.

- The expected difference is provided as: 70.

- Finally, calculate the Return on Expectations using the equation above:

ROEx = AD / ED *100

The values given above are inserted into the equation below and the solution is calculated:

ROEx = 45 / 70 *100 = 64.28 (%)

FAQ

What is Return on Expectations (ROEx) and why is it important?

Return on Expectations (ROEx) is a metric used to measure the performance of an investment, project, or any activity against its expected outcomes. It is calculated by dividing the actual difference (the real outcome) by the expected difference (the anticipated outcome), then multiplying by 100 to get a percentage. This metric is important because it provides insight into how well an initiative met its goals, helping businesses and individuals make informed decisions about future investments or actions.

How can ROEx be applied in business decision-making?

ROEx can be applied in various aspects of business decision-making, including evaluating the success of marketing campaigns, assessing the effectiveness of new strategies, and measuring the return on investments in new technologies or processes. By quantifying the extent to which expectations were met, businesses can identify areas of success and areas needing improvement, enabling more strategic allocation of resources and better planning for future projects.

Can ROEx be negative, and what does that indicate?

Yes, ROEx can be negative if the actual difference is less than the expected difference, indicating that the outcome was worse than anticipated. A negative ROEx suggests that an investment or project did not achieve its goals, and it may signal the need for a thorough review to understand the reasons behind the underperformance. This insight is crucial for making adjustments and avoiding similar outcomes in future endeavors.