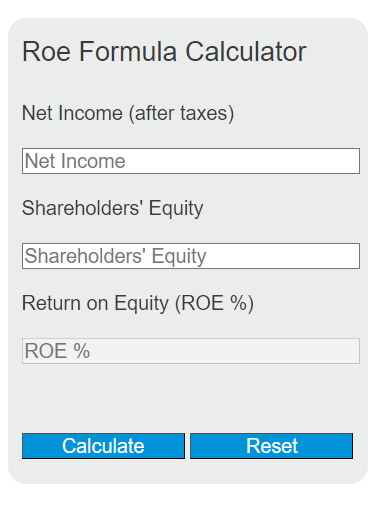

Enter the net income after taxes and the shareholders’ equity into the calculator to determine the Return on Equity (ROE). ROE is a measure of the profitability of a company in relation to the equity.

ROE Formula

The following formula is used to calculate the Return on Equity (ROE):

ROE = (Net Income / Shareholders' Equity) * 100%

Variables:

- ROE is the Return on Equity (%)

- Net Income is the profit of a company after all expenses and taxes have been deducted (after taxes)

- Shareholders’ Equity is the value of a company’s assets minus its liabilities

To calculate ROE, divide the net income by the shareholders’ equity and then multiply by 100 to get the percentage.

What is Return on Equity (ROE)?

Return on Equity (ROE) is a financial ratio that measures the profitability of a company in relation to the shareholders’ equity. It indicates how effectively management is using a company’s assets to create profits. A higher ROE suggests that the company is more efficient in generating profit from the equity financing provided by shareholders.

How to Calculate ROE?

The following steps outline how to calculate the Return on Equity (ROE).

- First, determine the net income of the company after all expenses and taxes have been deducted.

- Next, determine the shareholders’ equity, which is the value of the company’s assets minus its liabilities.

- Use the formula ROE = (Net Income / Shareholders’ Equity) * 100% to calculate the Return on Equity.

- Finally, calculate the ROE and express it as a percentage.

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem :

Use the following variables as an example problem to test your knowledge.

Net Income (after taxes) = $150,000

Shareholders’ Equity = $1,000,000