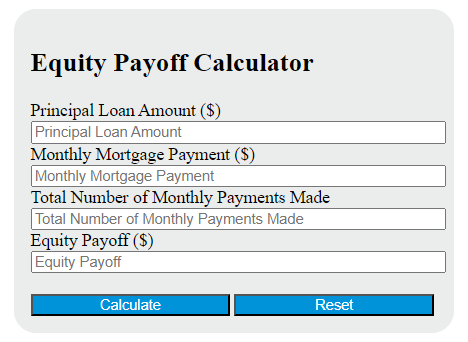

Enter the principal loan amount, the product of the monthly mortgage payment, and the total number of monthly payments made into the calculator to determine the equity payoff.

Equity Payoff Formula

The following formula is used to calculate the equity payoff.

EP = P - (MP * n)

Variables:

- EP is the equity payoff ($)

- P is the principal loan amount ($)

- MP is the monthly mortgage payment ($)

- n is the total number of monthly payments made

To calculate the equity payoff, multiply the monthly mortgage payment by the total number of monthly payments made. Subtract this result from the principal loan amount. The result is the equity payoff.

What is an Equity Payoff?

Equity payoff refers to the potential financial return an investor receives from an investment in a company’s equity, such as stocks or shares. This payoff can come in the form of dividends, which are regular payments made by the company from its profits, or capital gains, which are realized when the investor sells the equity for a higher price than they initially paid. The amount of equity payoff an investor receives depends on the company’s financial performance and market conditions.

How to Calculate Equity Payoff?

The following steps outline how to calculate the Equity Payoff.

- First, determine the principal loan amount ($).

- Next, determine the monthly mortgage payment ($).

- Next, determine the total number of monthly payments made (n).

- Next, gather the formula from above = EP = P – (MP * n).

- Finally, calculate the Equity Payoff.

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem :

Use the following variables as an example problem to test your knowledge.

principal loan amount ($) = 50000

monthly mortgage payment ($) = 1000

total number of monthly payments made (n) = 36