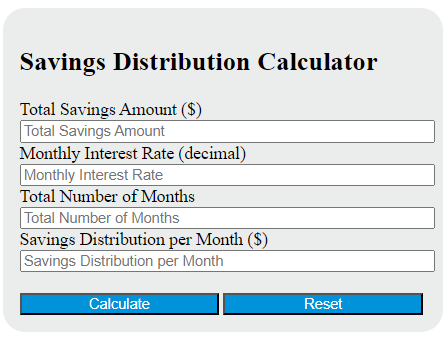

Enter the total savings amount, monthly interest rate, and total number of months into the calculator to determine the savings distribution per month.

Savings Distribution Formula

The following formula is used to calculate the savings distribution.

SD = P / ((1 - (1 + r)^-n) / r)

Variables:

- SD is the savings distribution per month ($)

- P is the total savings amount ($)

- r is the monthly interest rate (decimal)

- n is the total number of months

To calculate the savings distribution per month, subtract 1 from the sum of 1 and the monthly interest rate, raised to the power of the negative total number of months. Divide this result by the monthly interest rate. Finally, divide the total savings amount by the result obtained.

What is a Savings Distribution?

A savings distribution refers to the process of withdrawing funds from a savings account or other type of savings vehicle, such as a retirement or investment account. This can occur when the account holder needs to use the saved money for expenses or investments. The distribution may be subject to taxes or penalties, depending on the type of account and the account holder's age or financial situation.

How to Calculate Savings Distribution?

The following steps outline how to calculate the Savings Distribution.

- First, determine the total savings amount ($).

- Next, determine the monthly interest rate (decimal).

- Next, determine the total number of months.

- Next, gather the formula from above = SD = P / ((1 - (1 + r)^-n) / r).

- Finally, calculate the Savings Distribution.

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem :

Use the following variables as an example problem to test your knowledge.

total savings amount ($) = 5000

monthly interest rate (decimal) = 0.02

total number of months = 12