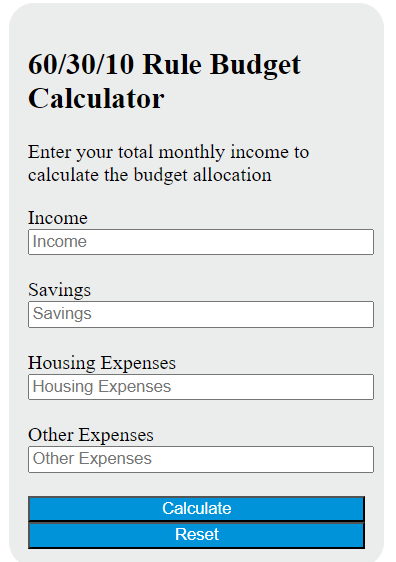

Enter the total monthly income into the calculator to determine the amount allocated for savings, housing expenses, and other expenses according to the 60/30/10 rule.

60/30/10 Rule Budget Formula

The following formula is used to calculate the budget allocation for the 60/30/10 rule:

Savings = (Income * 0.6)

Housing Expenses = (Income * 0.3)

Other Expenses = (Income * 0.1)

Variables:

- Savings is the amount allocated for savings

- Income is the total monthly income

To calculate the budget allocation for the 60/30/10 rule, multiply the total monthly income by 0.6 to determine the amount allocated for savings. Multiply the total monthly income by 0.3 to determine the amount allocated for housing expenses. Multiply the total monthly income by 0.1 to determine the amount allocated for other expenses.

What is a 60/30/10 Rule Budget?

The 60/30/10 rule budget is a simple and straightforward budgeting method that divides your income into three categories: needs, wants, and savings. According to this rule, 60% of your income should be allocated to needs, which include essential expenses such as rent or mortgage payments, groceries, utilities, health insurance, car payments, and other bills. The next 30% of your income should be allocated to wants, which include non-essential expenses such as dining out, entertainment, vacations, and shopping. The remaining 10% of your income should be allocated to savings or paying off debt. This rule is designed to provide a balanced approach to managing your money, ensuring that you cover your basic needs, enjoy your income, and build a financial safety net.