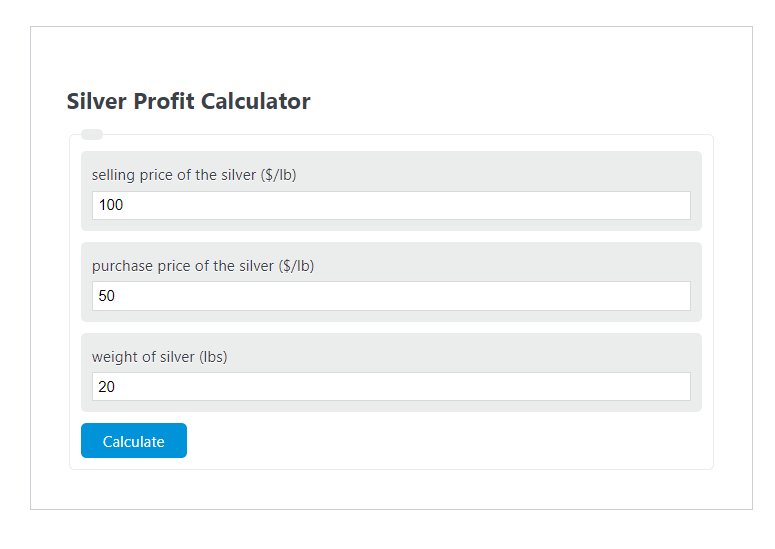

Enter the selling price of the silver ($/lb), the purchase price of the silver ($/lb), and the total weight of silver (lbs) into the calculator to determine the Silver Profit.

Silver Profit Formula

The following formula is used to calculate the Silver Profit.

SP = (S - PP) * WS

- Where SP is the Silver Profit ($)

- S is the selling price of the silver ($/lb)

- PP is the purchase price of the silver ($/lb)

- WS is the total weight of silver (lbs)

How to Calculate Silver Profit?

The following example problems outline how to calculate Silver Profit.

Example Problem #1

- First, determine the selling price of the silver ($/lb). In this example, the selling price of the silver ($/lb) is given as 15 .

- Next, determine the purchase price of the silver ($/lb). For this problem, the purchase price of the silver ($/lb) is given as 13 .

- Next, determine the total weight of silver (lbs). In this case, the total weight of silver (lbs) is found to be 2000.

- Finally, calculate the Silver Profit using the formula above:

SP = (S – PP) * WS

Inserting the values from above yields:

SP = (15 – 13) * 2000 = 4000 ($)

FAQ

What factors can affect the selling price of silver?

The selling price of silver can be influenced by various factors including market demand, geopolitical stability, currency values, interest rates, and mining costs. Additionally, the price of silver can be affected by its industrial demand, as it is used in numerous applications such as electronics, solar panels, and jewelry.

How can investors minimize risk when trading silver?

Investors can minimize risk by diversifying their investment portfolio, staying informed about market trends, setting stop-loss orders to limit potential losses, and investing in silver through various instruments such as physical silver, silver ETFs, or silver mining stocks. It’s also prudent to have a clear investment strategy and to avoid making impulsive decisions based on short-term market fluctuations.

Is investing in silver a good way to hedge against inflation?

Investing in silver can be considered a hedge against inflation because, historically, the value of precious metals tends to increase when the purchasing power of fiat currencies decreases. However, like any investment, silver has its risks and its performance should be evaluated in the context of an individual’s overall investment strategy and risk tolerance.