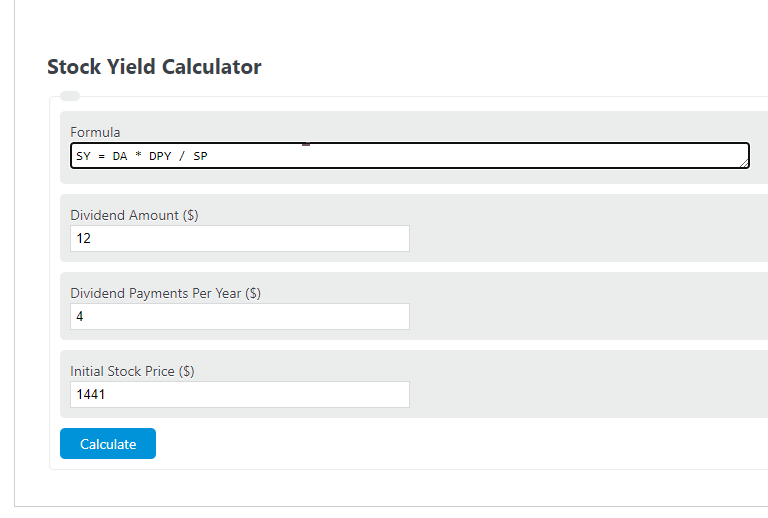

Enter the dividend amount, dividends payments per year, and the initial share price into the calculator to determine the stock yield.

Stock Yield Formula

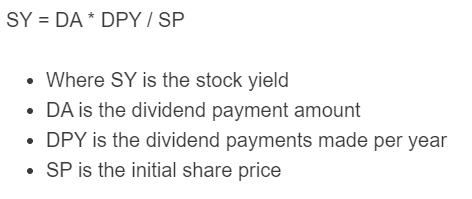

The following formula is used to calculate a stock yield.

SY = DA * DPY / SP

- Where SY is the stock yield

- DA is the dividend payment amount

- DPY is the dividend payments made per year

- SP is the initial share price

The dividend payment amount refers to the sum of money a company pays to its shareholders as a distribution of profits.

Dividend payments made per year refers to the frequency at which a company distributes profits to its shareholders in the form of cash or additional shares.

The initial share price refers to the price at which a company’s shares are first offered to the public for trading on a stock exchange.

Stock Yield Definition

What is a stock yield? A stock yield is a ratio of the total dividends paid per year over the initial share price of the stock. This term is also often used interchangeably with dividend yield.

Example Problem

How to calculate stock yield?

- First, determine the dividend payment amount.

For this example, the stock pays out $25.00 per dividend period.

- Next, determine the number of payments made each year.

Typically, shares will pay our dividends on a quarterly, semi-annual, or annual basis. For this problem, the dividends are paid quarterly which means 4 times per year.

- Next, determine the initial share price.

These shares were purchased at a price of $250.00.

- Finally, calculate the stock yield.

Using the formula above, and the information from previous steps, the stock yield is found to be (25*4)/250 = 100/250 = .40 = 40%.

FAQ

What factors can affect the dividend yield of a stock?

Several factors can influence the dividend yield of a stock, including changes in the dividend payment amount, fluctuations in the stock price, and the company’s financial health and profitability. Economic conditions and market sentiment can also play significant roles.

Is a higher dividend yield always better?

Not necessarily. While a higher dividend yield may seem attractive, it could also indicate potential risks. For example, a high yield might result from a significant drop in the stock price due to underlying issues with the company. It’s important to analyze the reasons behind a high yield.

How do dividend payments affect stock prices?

Typically, when a company announces a dividend payment, its stock price can increase up to the ex-dividend date due to increased demand. After the ex-dividend date, the stock price may decrease by approximately the amount of the dividend, reflecting the payout.

Can stock yields predict future stock performance?

While stock yields provide valuable information about a company’s current financial health and the income potential of its stock, they are not reliable predictors of future stock performance. Other factors, such as market conditions, company growth, and economic indicators, should also be considered when evaluating potential investments.