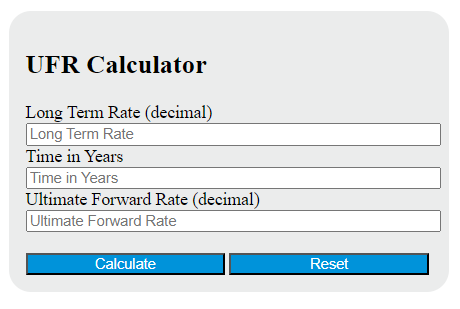

Enter the Long Term Rate and time in years into the calculator to determine the Ultimate Forward Rate. This calculator can also evaluate any of the variables given the others are known.

Ufr Formula

The following formula is used to calculate the Ufr (Ultimate Forward Rate) in a Ufr Calculator.

UFR = (1 + LTR)^{1/T - 1}Variables:

- UFR is the Ultimate Forward Rate (decimal)

- LTR is the Long Term Rate (decimal)

- T is the time in years

To calculate the Ultimate Forward Rate, add 1 to the Long Term Rate. Raise the result to the power of 1 divided by the time in years. Subtract 1 from the result to get the Ultimate Forward Rate.

What is a Ufr?

A UFR, or Ultimate Forward Rate, is a method used in the valuation of long-term liabilities in insurance and pension funds. It is a theoretical rate that long-term interest rates are expected to converge to over time. The UFR is used to extrapolate the risk-free interest rate term structure for long maturities when market data is not available. It is a key component in the calculation of the solvency capital requirement for insurance companies under the Solvency II regulatory framework.

How to Calculate Ufr?

The following steps outline how to calculate the Ultimate Forward Rate (UFR) using the given formula:

- First, determine the value of the Long Term Rate (LTR) (decimal).

- Next, determine the value of time (T) in years.

- Next, substitute the values of LTR and T into the formula: UFR = (1 + LTR)^(1/T) – 1.

- Finally, calculate the Ultimate Forward Rate (UFR).

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem:

Use the following variables as an example problem to test your knowledge:

Long Term Rate (LTR) = 0.05

Time (T) in years = 3