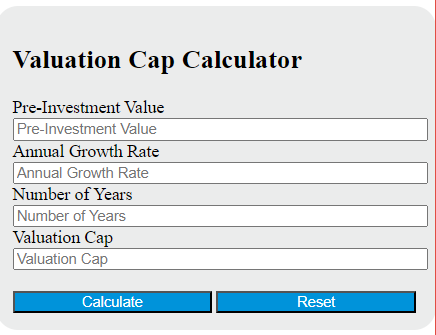

Enter the pre-investment value, annual growth rate, and number of years into the calculator to determine the valuation cap.

Valuation Cap Formula

The following formula is used to calculate the valuation cap.

VC = (PI * (1 + r)^n)

Variables:

- VC is the valuation cap

- PI is the pre-investment value

- r is the annual growth rate

- n is the number of years

To calculate the valuation cap, multiply the pre-investment value by the sum of 1 and the annual growth rate raised to the power of the number of years. The result is the valuation cap.

What is a Valuation Cap?

A valuation cap is a term used in startup financing that refers to the maximum valuation at which an investor is willing to invest in a company. It is often used in convertible note financing and seed rounds to protect early-stage investors from excessive dilution. If a startup’s valuation at a subsequent funding round exceeds the cap, the early investor’s stake is calculated based on the cap, not the higher valuation, thus providing them with more shares for their investment.

How to Calculate Valuation Cap?

The following steps outline how to calculate the Valuation Cap using the given formula:

- First, determine the pre-investment value (PI).

- Next, determine the annual growth rate (r).

- Next, determine the number of years (n).

- Next, calculate (1 + r)^n.

- Finally, multiply PI by the result from step 4 to calculate the Valuation Cap (VC).

Example Problem:

Use the following variables as an example problem to test your knowledge:

pre-investment value (PI) = $500,000

annual growth rate (r) = 0.05

number of years (n) = 3