Enter the interest rate per period and number of periods to calculate the present value interest factor of an annuity using this PVIFA calculator.

PVIFA Formula

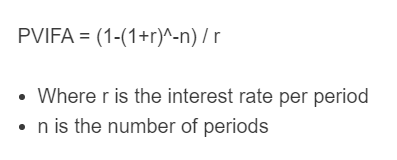

The formula for calculating the present value interest factor of annuity is as follows:

PVIFA = (1-(1+r)^{-n}) / r- Where r is the interest rate per period

- n is the number of periods

To calculate PVIFA, raise 1 plus the rate per period by the negative number of periods, subtract this value from 1, then divide by the rate per period.

PVIFA Definition

What is PVIFA? PVIFA is defined as the present value of the interest factor of an annuity. This factor is often used to determine an ordinary annuity or the present value of some series of annuities. This is done by multiplying a recurring payment by the factor.

What does PVIFA mean in economics? PVIFA is a term used in the fields of economics, finance, and accounting. PVIFA stands for the present value of interest factor of the annuity.

What is PVIFA used for? PVIFA is used to determine whether taking a single payment immediately or several annuity payments in the future is more beneficial to an individual or business. In other words, whether there is more value in future payments of a single payment now. This factor can only be used when the payments in the future are constant and known.

How to calculate PVIFA?

- First, determine the average interest rate per period. The interest rate per period is typically constant, but if it is not, use the average of all of the periods. For this example, we will assume a standard yearly return of 8%.

- Next, determine the number of periods. For this problem, the time period being analyzed is 5 years long, which is equal to 5 periods.

- Finally, calculate the PVIFA. Using the formula above, the PVIFA is determined to be (1-(1+.08)^5) / .08 = 3.992

PVIFA Table

The following table shows PVIFA values for periods of 1 to 50 and interest rates from 1% to 22%.

How to do PVIFA table in excel? The below table was created using excel. To replicate this table, set up the desired periods and interest rates and then use the cell formula in the 1 x 1 location (shown bold below) as =(1-(1+$B$2)^(-A3))/($B$2). Afterward, drag the formula to the right and then down to fill the tables.