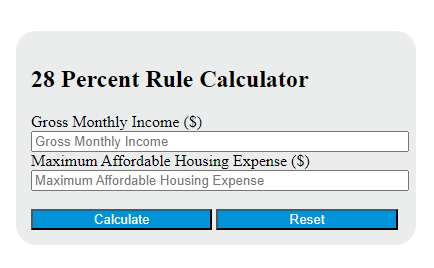

Enter the gross monthly income into the calculator to determine the maximum affordable housing expense.

28 Percent Rule Formula

The following formula is used to calculate the maximum affordable housing expense based on the 28 Percent Rule.

HE = (GI * 0.28)

Variables:

- HE is the maximum affordable housing expense ($)

- GI is the gross monthly income ($)

To calculate the maximum affordable housing expense, multiply the gross monthly income by 0.28 (which represents 28%). The result is the maximum amount that should be spent on total housing expenses, including mortgage payments, property taxes, homeowners insurance, and any homeowners association fees.

What is a 28 Percent Rule?

The 28 Percent Rule is a guideline used in the financial world to determine how much debt an individual or household can afford. It states that a household should spend a maximum of 28% of its gross monthly income on total housing expenses. These expenses include mortgage payments, property taxes, homeowners insurance, and any homeowners association fees. This rule is used by lenders and creditors to assess the risk level of potential borrowers and to ensure they won’t default on their loans.