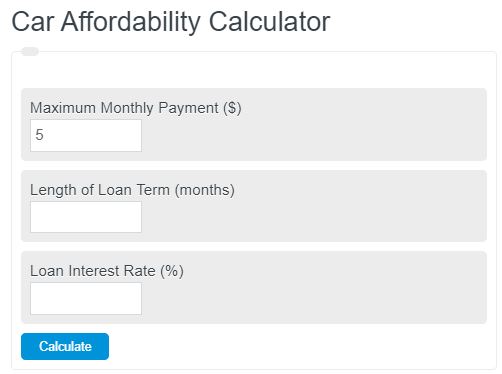

Enter the maximum monthly payment you can afford, the term of the loan, and the interest rate of the loan into the car affordability calculator. The calculator will return the maximum car value you can afford.

- Mortgage Calculator

- Home Affordability Calculator

- Car Depreciation Calculator (% per year)

- Emergency Fund Calculator

Car Affordability Formula

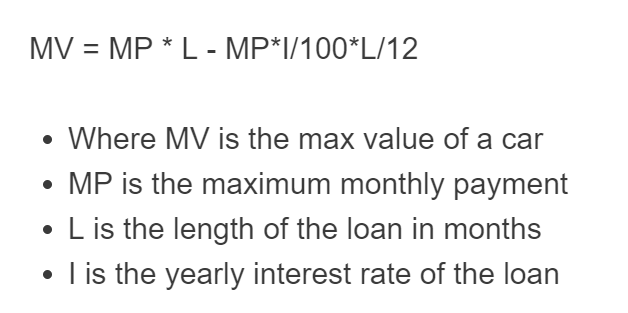

The following formula is used to calculate the maximum value of a car you can afford.

MV = MP * L - MP*I/100*L/12

- Where MV is the max value of a car

- MP is the maximum monthly payment

- L is the length of the loan in months

- I is the yearly interest rate of the loan

The maximum amount can be paid each month towards a specific expense or loan.

The length of the loan in months refers to the duration of time it will take to repay the borrowed amount fully.

The yearly interest rate of a loan refers to the percentage of the loan amount that the borrower must pay annually as interest.

Car Affordability Definition

Car affordability is the recommended total value of a car that a person can afford based on their income.

How much can I afford to spend on a car?

How to calculate the maximum car value you can afford.

- First, determine your maximum monthly payments

In general, this should not exceed 12% of your pretax income. For example, if you make $1,000.00 per month, your car payment should not exceed $120/month.

- Next determine the length of the loan you will take out for the car

The longer the loan the lower the monthly payments, but the higher the interest rate.

- Determine the interest rate of the loan

This is typically anywhere from 3-7% depending on your credit score.

- Calculate the max value car you can afford

Enter the information from steps 1-3 into the calculator to determine the max value of a car you can afford.

FAQ

How does the interest rate affect the total cost of a car loan?

The interest rate directly impacts the total amount you will pay for a car loan. A higher interest rate increases the overall cost of the loan because you will pay more in interest charges over the life of the loan. Conversely, a lower interest rate reduces the total cost.

Why is it important to consider the length of a car loan?

The length of a car loan, or loan term, is crucial because it affects your monthly payment amount and the total interest paid over the life of the loan. Longer terms lower monthly payments but increase the total interest paid, while shorter terms have higher monthly payments but lower total interest costs.

Can making a down payment change the affordability of a car?

Yes, making a down payment can significantly affect car affordability. A larger down payment reduces the amount you need to borrow, which can lower your monthly payments and decrease the total interest paid over the life of the loan, making a more expensive car more affordable.

How does one’s credit score affect car loan terms?

Your credit score plays a significant role in determining the interest rate you are offered on a car loan. A higher credit score generally qualifies you for lower interest rates, which can make a car more affordable by reducing the total interest paid over the life of the loan.