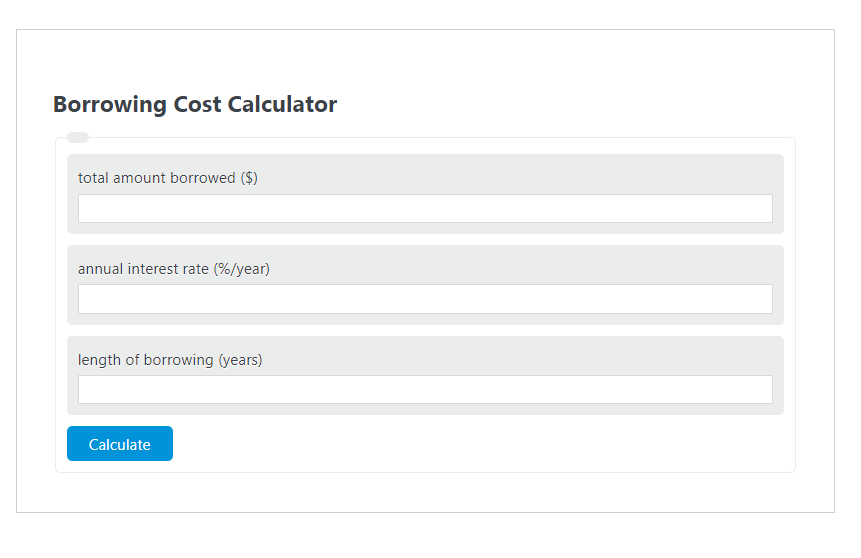

Enter the total amount borrowed ($), the annual interest rate (%/year), and the length of borrowing (years) into the Borrowing Cost Calculator. The calculator will evaluate and display the Borrowing Cost.

- All Cost Calculators

- Capitalized Interest Calculator

- Financing Cost Calculator

- Interest Cost Calculator

Borrowing Cost Formula

The following formula is used to calculate the Borrowing Cost.

BC = A * I/100 * T

- Where BC is the Borrowing Cost ($)

- AC is the total amount borrowed ($)

- I is the annual interest rate (%/year)

- T is the length of borrowing (years)

To calculate the borrowing cost, multiply the total amount borrowed by the annual interest rate, then multiply by the borrowing term length.

How to Calculate Borrowing Cost?

The following example problems outline how to calculate Borrowing Cost.

Example Problem #1

- First, determine the total amount borrowed ($). The total amount borrowed ($) is given as 5000 .

- Next, determine the annual interest rate (%/year). The annual interest rate (%/year) is calculated as 2 .

- Next, determine the length of borrowing (years). The length of borrowing (years) is found to be 10.

- Finally, calculate the Borrowing Cost using the formula above:

BC = A * I/100 * T

Inserting the values from above yields:

BC = 5000 * 2/100 * 10 = 1000 ($)

FAQ

What factors influence the total borrowing cost?

The total borrowing cost is influenced by three main factors: the total amount borrowed, the annual interest rate, and the length of the borrowing period. Changes in any of these variables can significantly affect the overall cost of borrowing.

How can one reduce the borrowing cost?

To reduce the borrowing cost, one can consider borrowing a lower amount, securing a lower interest rate, or reducing the length of the borrowing period. Additionally, making more frequent payments or paying more than the minimum payment can also help reduce the total interest paid over time.

Is it possible to negotiate the terms of borrowing to achieve a lower borrowing cost?

Yes, in many cases, it is possible to negotiate the terms of borrowing, especially the interest rate and the length of the loan. This is more common with private lenders and in situations where the borrower has a good credit score or an existing relationship with the lender. Negotiating better terms can lead to significant savings on the total borrowing cost.