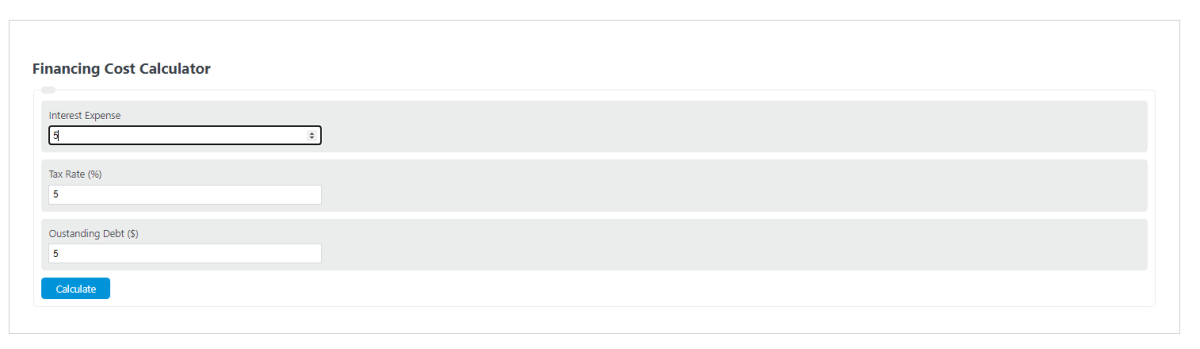

Enter the interest expense, tax rate, and outstanding debt into the calculator to determine the financing cost.

- All Cost Calculators

- Cost of Debt Calculator

- Cost of Equity Calculator

- Cost of Capital Calculator

- Net Cash Flow Calculator

Financing Cost Formula

The following formula is used to calculate a financing cost, also known as a cost of debt.

FC = IE * (1-TR/D)

- Where FC is the financing cost/cost of debt ($)

- IE is the interest expense ($)

- TR is the tax rate (decimal)

- D is the outstanding debt ($)

To calculate the financing cost, multiply the interest expense, by 1 minus the tax rate over the outstanding debt.

Financing Cost Definition

A financing cost is defined as the cost of raising funds for the purpose of purchasing an asset or making an investment with the intent to set up and run a business with those funds.

Example Problem

How to calculate financing cost?

First, determine the interest expense. For this example, the interest expense is $10,000.00.

Next, determine the tax rate. The tax rate on the expense is 5%. in decimal form this would be .05.

Next, determine the outstanding debt value. The outstanding debt on the asset is $5,000.00.

Finally, calculate the financing cost.

Using the formula above, the financing cost in this problem is found to be:

FC = IE * (1-TR/D)

= 10,000*((1-.05)/5000)

= 1.9

FAQ

What factors can affect the cost of debt for a company?

The cost of debt for a company can be influenced by several factors including the prevailing interest rates, the company’s credit rating, the term of the debt, and market conditions. A higher credit rating, for instance, typically results in lower interest expenses due to perceived lower risk by lenders.

How does the tax rate impact the financing cost?

The tax rate impacts the financing cost through the tax shield on interest payments. Since interest expenses are deductible, the effective cost of debt is reduced by the tax rate. A higher tax rate increases the tax shield, thereby reducing the net cost of debt for the company.

Why is it important to calculate the cost of debt?

Calculating the cost of debt is crucial for businesses as it helps in assessing the effectiveness of financing strategies, comparing different financing options, and making informed decisions on capital structure. It also plays a significant role in the calculation of a company’s overall cost of capital, which is essential for budgeting and investment analysis.