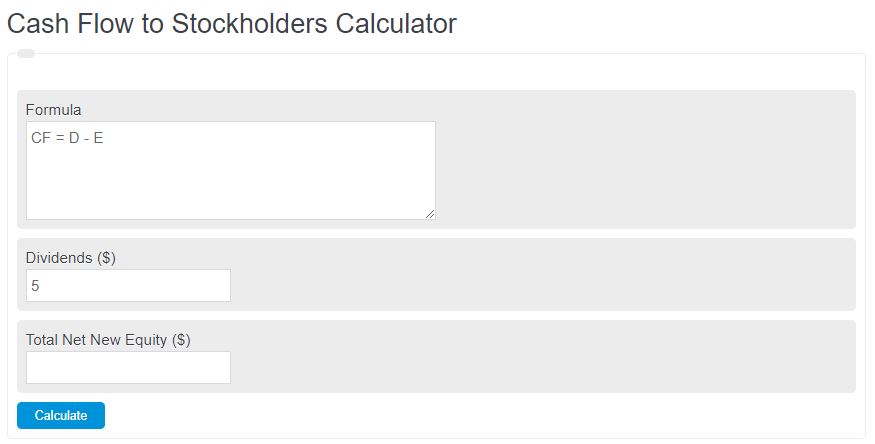

Enter the total dividends paid and the net new equity raised into the calculator to determine the cash flow to stockholders.

- Net Cash Flow Calculator

- Equity Value Calculator

- Dividends Per Share Calculator

- Cash Flow to Creditors Calculator

- Cash Flow Per Share Calculator

Cash Flow to Stockholders Formula

The following equation is used to calculate the cash flow to stockholders.

CF = D - E

- Where CF is the cash flow to stockholders

- E is the total net new equity raised

- D is the total dividends

To calculate cash flow to stockholders, subtract the total dividends from the total net new equity raised in the funding round.

Cash Flow To Stockholders Definition

The total cash flow to stockholders is the amount of cash that moves to stockholders after new raised equity has been issued.

Cash Flow To Stockholders Example

How to calculate cash flow to stockholders?

- First, determine the total new equity raised.

Calculate the value of the new equity.

- Next, determine the total dividends.

Calculate the total dividends paid to investors.

- Finally, calculate the cash flow to stockholders.

Use the equation above to calculate the cash flow to stockholders.

FAQ

Cash flow to stockholders is the amount of cash that moves to stockholders through dividends after new equity is accounted for.

This is calculated by subtracting the total new equity from the total dividends.