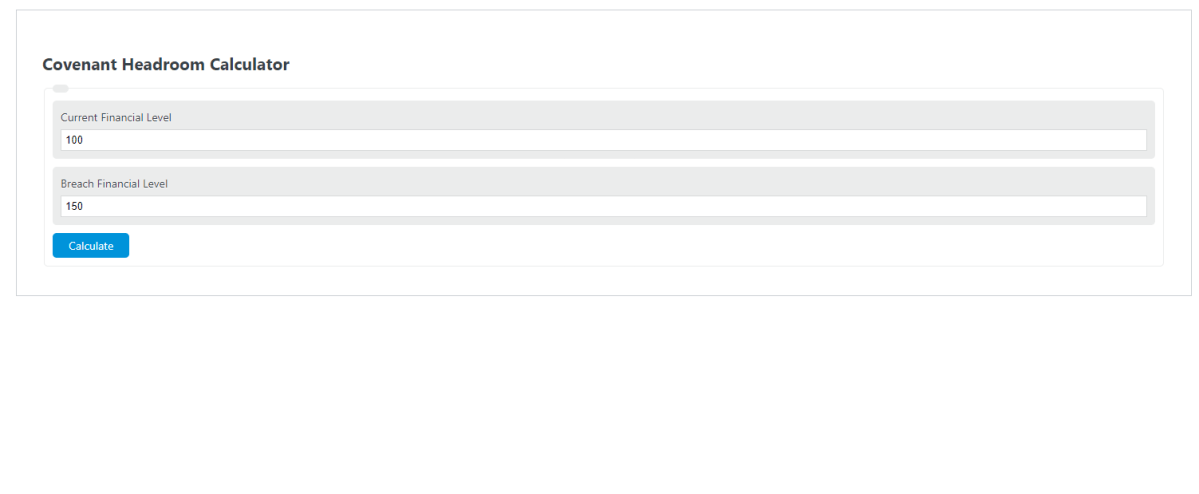

Enter the current level of the financial covenant and the level at which a covenant would be breached to determine the Covenant Headroom.

- Financial Leverage Calculator

- Cost Indifference Point Calculator

- Index Cost of Acquisition Calculator

Covenant Headroom Formula

The following equation is used to calculate the Covenant Headroom.

CH = BL - CL

- Where Ch is the Covenant Headroom

- BL is the financial breach level

- CL is the current financial level

To calculate the Covenant Headroom, subtract the current financial level from the agreed-upon breach level.

What is a Covenant Headroom?

Definition:

A Covenant Headroom is a measure of the difference between the current level of a position and the limit of a financial situation.

How to Calculate Covenant Headroom?

Example Problem:

The following example outlines the steps and information needed to calculate Covenant Headroom.

First, determine the current financial level. For this example, we will look at a trading position of $100,000.00.

Next, determine the trading limit. In this case, the limit is $150,000.00.

Finally, calculate the Covenant Headroom using the formula above:

CH = BL – CL

CH = $150000 – $100000

CH = $50,000.00

FAQ

What is the importance of monitoring Covenant Headroom?

Monitoring Covenant Headroom is crucial for businesses and investors as it helps in assessing the financial health and operational flexibility of a company. It indicates how close a company is to breaching its financial covenants, allowing for timely adjustments in strategy to avoid defaulting on agreements.

How can a company increase its Covenant Headroom?

A company can increase its Covenant Headroom by improving its financial position either by increasing revenue, reducing expenses, or repaying debt. Strategic financial planning and operational efficiency are key to enhancing a company’s Covenant Headroom.

What happens if a covenant is breached?

If a covenant is breached, the lender may have the right to call the loan, alter the terms of the loan agreement, or enforce penalties. It often leads to negotiations between the borrower and the lender to find a feasible solution for both parties, which might include restructuring the debt or providing additional collateral.