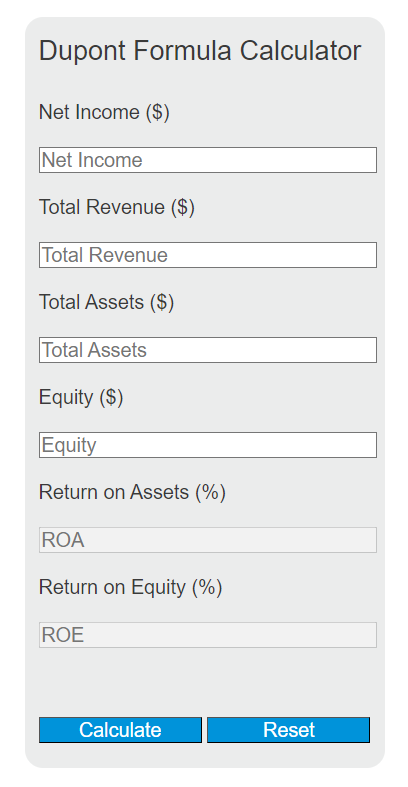

Enter the net income, total revenue, total assets, and equity into the calculator to determine the Return on Assets (ROA) and Return on Equity (ROE) using the Dupont Formula. This calculator helps to decompose the different components that affect a company’s financial performance.

Dupont Formula

The Dupont Formula is used to calculate a company’s Return on Equity (ROE) by breaking it down into three parts: Profit Margin, Asset Turnover, and Equity Multiplier.

text{ROE} = left( frac{text{Net Income}}{text{Total Revenue}} right) times left( frac{text{Total Revenue}}{text{Total Assets}} right) times left( frac{text{Total Assets}}{text{Equity}} right)

Variables:

- Net Income is the company’s total earnings or profit.

- Total Revenue is the total amount of income generated by the sale of goods or services related to the company’s primary operations.

- Total Assets is the sum of all assets owned by the company.

- Equity is the value of the company provided by the shareholders.

To calculate ROE using the Dupont Formula, multiply the net profit margin (Net Income / Total Revenue) by the asset turnover (Total Revenue / Total Assets) and then by the equity multiplier (Total Assets / Equity). The result is the Return on Equity (ROE). The Return on Assets (ROA) is calculated as the product of the net profit margin and the asset turnover.

What is the Dupont Formula?

The Dupont Formula is a financial analysis tool that provides a more detailed look at the factors that contribute to a company’s return on equity (ROE). It helps to understand how efficiently a company is using its assets to generate profit and how effectively it is leveraging its equity. By breaking down ROE into three components, analysts can pinpoint areas of strength and weakness in a company’s operations and financial structure.

How to Calculate ROE using the Dupont Formula?

The following steps outline how to calculate the Return on Equity using the Dupont Formula.

- First, determine the Net Income of the company.

- Next, determine the Total Revenue generated by the company.

- Then, determine the Total Assets owned by the company.

- After that, determine the Equity provided by the shareholders.

- Use the Dupont Formula to calculate ROE: ROE = (Net Income / Total Revenue) * (Total Revenue / Total Assets) * (Total Assets / Equity).

- Calculate the Return on Assets (ROA) as well: ROA = (Net Income / Total Revenue) * (Total Revenue / Total Assets).

- Finally, enter the values into the calculator to verify the results.

Example Problem :

Use the following variables as an example problem to test your knowledge.

Net Income = $150,000

Total Revenue = $500,000

Total Assets = $1,000,000

Equity = $600,000