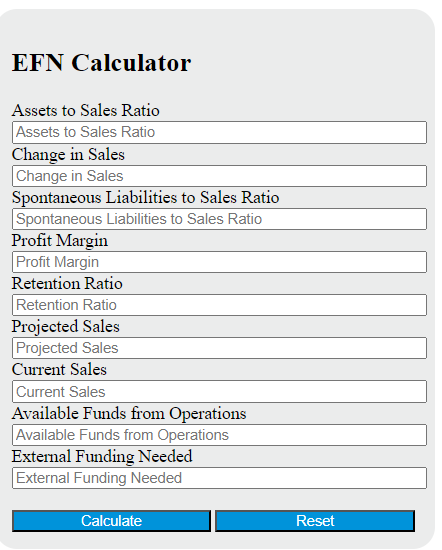

Enter the assets to sales ratio, change in sales, spontaneous liabilities to sales ratio, profit margin, retention ratio, projected sales, current sales, and available funds from operations into the calculator to determine the External Funding Needed.

Efn (External Funding Needed) Formula

The following formula is used to calculate the External Funding Needed (EFN).

EFN = (A/S)ΔS + (L/S)ΔS - M(1+RR)(S1 - S) - AFN

Variables:

- EFN is the External Funding Needed ($)

- A/S is the assets to sales ratio

- ΔS is the change in sales

- L/S is the spontaneous liabilities to sales ratio

- M is the profit margin

- RR is the retention ratio

- S1 is the projected sales

- S is the current sales

- AFN is the available funds from operations

To calculate the External Funding Needed, multiply the assets to sales ratio and the change in sales. Add the product of the spontaneous liabilities to sales ratio and the change in sales. Subtract the product of the profit margin, the sum of 1 and the retention ratio, and the difference between the projected sales and the current sales. Finally, subtract the available funds from operations from the result.

What is a Efn (External Funding Needed)?

External Funding Needed (EFN) is a financial concept that calculates the amount of additional funding a company needs to sustain its level of operations, given its current financial structure. It is determined by examining the company’s projected growth rate, current assets, liabilities, and retained earnings. If the EFN is positive, it indicates that the company needs to secure additional financing, either through debt, equity, or a combination of both. If the EFN is negative, it means the company has excess funds that can be used for investment or to pay off existing debt.

How to Calculate Efn (External Funding Needed)?

The following steps outline how to calculate the External Funding Needed (EFN) using the given formula:

- First, determine the Assets to Sales ratio (A/S).

- Next, determine the change in sales (ΔS).

- Next, determine the Spontaneous Liabilities to Sales ratio (L/S).

- Next, determine the Profit Margin (M).

- Next, determine the Retention Ratio (RR).

- Next, determine the Projected Sales (S1).

- Next, determine the Current Sales (S).

- Finally, calculate the External Funding Needed (EFN) using the formula EFN = (A/S)ΔS + (L/S)ΔS – M(1+RR)(S1 – S) – AFN.

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem :

Use the following variables as an example problem to test your knowledge:

Assets to Sales ratio (A/S) = 0.8

Change in sales (ΔS) = 100

Spontaneous Liabilities to Sales ratio (L/S) = 0.5

Profit Margin (M) = 0.2

Retention Ratio (RR) = 0.3

Projected Sales (S1) = 500

Current Sales (S) = 400

Available funds from operations (AFN) = 200