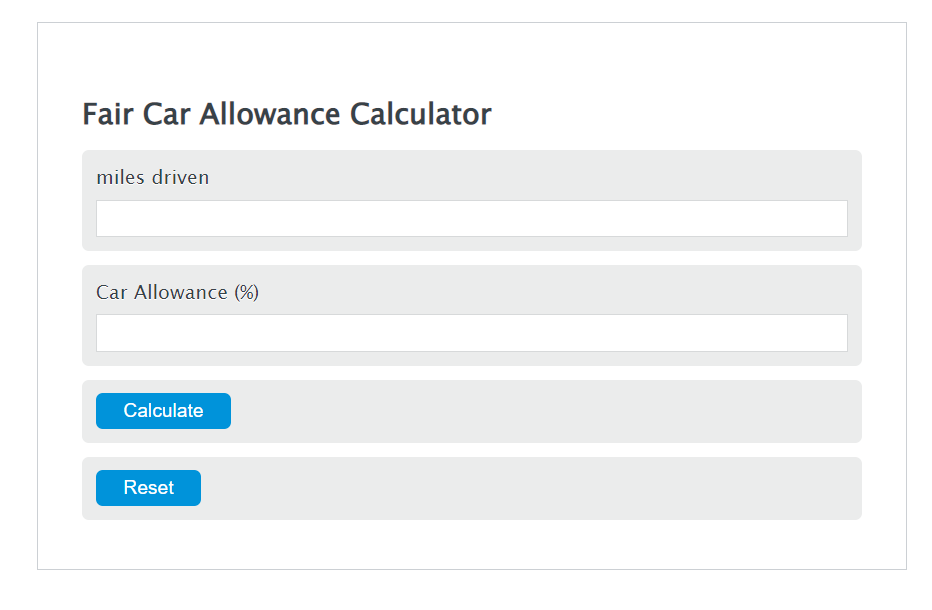

Enter the miles driven into the Calculator. The calculator will evaluate the Car Allowance.

- Total Car Cost Calculator

- Rental Car Cost Per Day Calculator

- Car Depreciation Calculator (% per year)

Car Allowance Formula

FCA = M * .656

Variables:

- FCA is the Car Allowance ($)

- M is the miles driven

To calculate Car Allowance, multiply the miles driven by .656.

How to Calculate Car Allowance?

The following steps outline how to calculate the Car Allowance.

- First, determine the miles driven.

- Next, gather the formula from above = FCA = M * .656.

- Finally, calculate the Car Allowance.

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem :

Use the following variables as an example problem to test your knowledge.

miles driven = 500

Frequently Asked Questions

What factors can affect the car allowance rate?

The car allowance rate can be affected by various factors including the type of vehicle, fuel efficiency, maintenance costs, insurance costs, and the geographical area in which the vehicle is driven due to variations in fuel prices and other expenses.

Is the car allowance rate the same for all types of vehicles?

No, the car allowance rate is not the same for all types of vehicles. It can vary depending on the vehicle’s fuel efficiency, maintenance costs, and other factors that affect the total cost of operating the vehicle.

Can I claim more than the calculated car allowance on my taxes?

Claiming more than the calculated car allowance on your taxes depends on the documentation and justification of actual expenses incurred. It is important to keep detailed records of all car-related expenses if you plan to claim more than the standard allowance.

How often should I calculate my car allowance?

It’s recommended to calculate your car allowance periodically, especially if there are significant changes in your driving patterns, vehicle costs, or if you change vehicles. This ensures that the allowance accurately reflects your current expenses.