Frequently Asked Questions

FCFE indicates a company’s ability to generate cash that can be distributed to shareholders. A positive FCFE implies that a company has enough cash to cover its capital expenditures and repay its debt while still having cash available for shareholders. A consistently high FCFE can be a sign of a healthy company, while a negative FCFE may indicate financial troubles or the need for external financing.

Free Cash Flow (FCF) represents the cash a company generates after accounting for cash outflows to support operations and maintain its capital assets. FCFE, on the other hand, measures the cash available to equity shareholders after taking into account capital expenditures and net debt issued. In other words, FCFE is the portion of FCF that is available to equity shareholders.

FCFE is important for investors because it provides insight into a company’s ability to generate cash that can be distributed to shareholders. A positive and consistent FCFE suggests that a company can support dividend payments, share buybacks, or reinvest in the business to grow, which can increase shareholder value. A declining or negative FCFE may signal financial difficulties, potentially affecting the company’s stock price and dividends.

Yes, FCFE can be negative. A negative FCFE means that a company’s cash from operations is not sufficient to cover its capital expenditures and debt obligations, indicating that the company may need external financing or to cut back on investments. It could also signal financial difficulties, which might impact the company’s ability to pay dividends or invest in growth opportunities.

A company can improve its FCFE by increasing its cash flow from operations, reducing capital expenditures, or managing its net debt more efficiently. This can be achieved through various strategies such as optimizing operations, cutting costs, improving sales, or divesting underperforming assets. A company should strike a balance between growth and cash generation to ensure sustainable growth and value creation for shareholders.

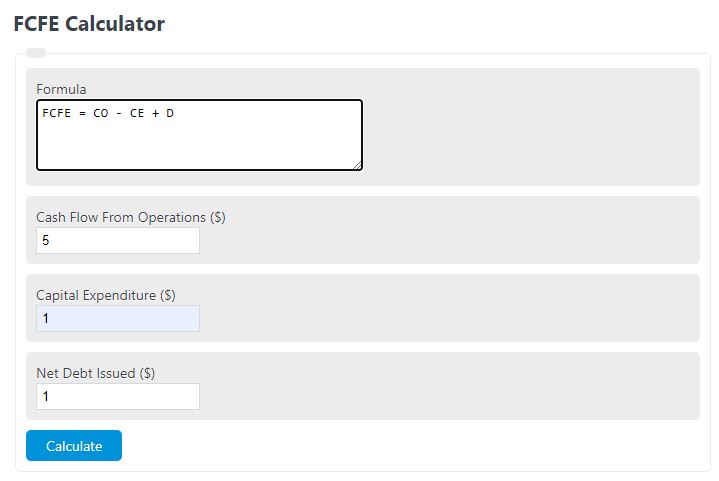

Enter the total cash flows from operations, capital expenditures, and net debt issues into the calculator to determine the free cash flow to equity.

- Cash Flow to Stockholders Calculator

- Cash Flow From Assets Calculator

- Free Cash Flow Calculator

- Net Cash Flow Calculator

FCFE Formula

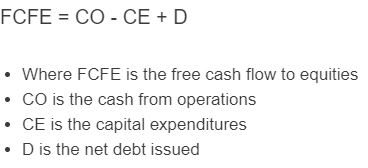

The following formula is used to calculate the free cash flow to equity.

FCFE = CO - CE + D

- Where FCFE is the free cash flow to equities

- CO is the cash from operations

- CE is the capital expenditures

- D is the net debt issued

FCFE Definition

Free cash flow to equities is the total sum of the cash from operations and net debt issued minus the capital expenditure.

FCFE Example

How to calculate FCFE?

- First, determine the cash flow from operation.

Calculate the net cash flow generated by operations in the company.

- Next, determine the total CE.

Calculate the total amount of capital expenditure spent on the company.

- Next, determine the net debt issued.

Calculate the total amount of net debt that has been issued/repaid.

- Finally, calculate the FCFE.

Calculate the FCFE by subtracting the capital expenditures from the cash and then adding the net debt.