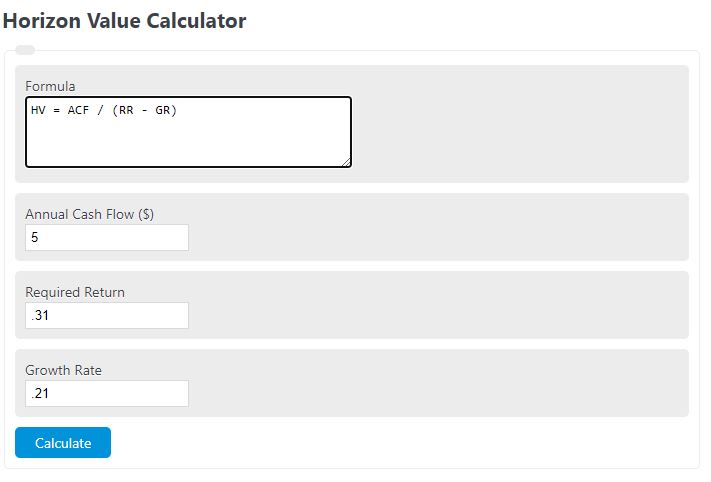

Enter the annual cash flow beyond a certain time, the required return, and the growth rate to determine the horizon value.

- Required Rate of Return Calculator

- Growth Rate Calculator

- Net Cash Flow Calculator

- Cash Flow Per Share Calculator

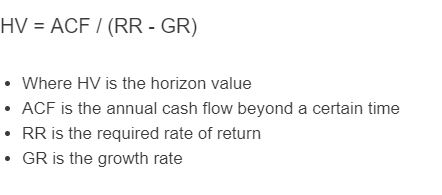

Horizon Value Formula

The following formula is used to calculate a horizon value.

HV = ACF / (RR - GR)

- Where HV is the horizon value

- ACF is the annual cash flow beyond a certain time

- RR is the required rate of return

- GR is the growth rate

To calculate horizon value, divide the annual cash flow by the difference between the required rate of return by the growth rate.

Horizon Value Definition

A horizon value is the expected value of a security or investment at a future date.

Horizon Value Example

How to calculate a horizon value?

- First, determine the annual cash flow.

This will be the assumed cash flow for the foreseeable future. For this example, this value is $40,000.00

- Next, determine the required return.

For this example the required return is .40 or 40%.

- Next, determine the growth rate.

The growth rate for this example is .20 or 20%.

- Finally, calculate the horizon value.

HV = ( $40,000.00 / (.40-.20) ) = $200,000.00

FAQ

A horizon value, also known as a terminal value, is the value of a security or asset at some future date.

The horizon value is used for cash flow models and analysis.