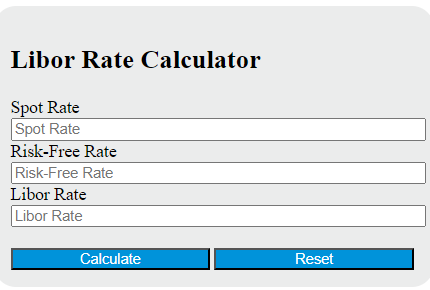

Enter the Spot Rate and the Risk-Free Rate into the calculator to determine the Libor Rate. This calculator can also evaluate any of the variables given the others are known.

Libor Rate Formula

The following formula is used to calculate the Libor Rate.

LR = (1 + S) / (1 + R) - 1

Variables:

- LR is the Libor Rate (decimal)

- S is the Spot Rate (decimal)

- R is the Risk-Free Rate (decimal)

To calculate the Libor Rate, add 1 to the Spot Rate and divide it by the sum of 1 and the Risk-Free Rate. Subtract 1 from the result to get the Libor Rate.

What is a Libor Rate?

The Libor Rate, or London Interbank Offered Rate, is a benchmark interest rate at which major global banks lend to one another in the international interbank market for short-term loans. It serves as a reference point for a wide range of financial products worldwide, including mortgages, student loans, and credit cards. The rate is calculated and published each business day by the Intercontinental Exchange (ICE).

How to Calculate Libor Rate?

The following steps outline how to calculate the Libor Rate using the given formula:

- First, determine the Spot Rate (S) and the Risk-Free Rate (R) values.

- Next, insert the values of S and R into the formula: LR = (1 + S) / (1 + R) – 1.

- Finally, calculate the Libor Rate (LR) using the formula.

- After inserting the values and calculating the result, check your answer with the calculator above.

Example Problem:

Use the following variables as an example problem to test your knowledge:

Spot Rate (S) = 0.05

Risk-Free Rate (R) = 0.02