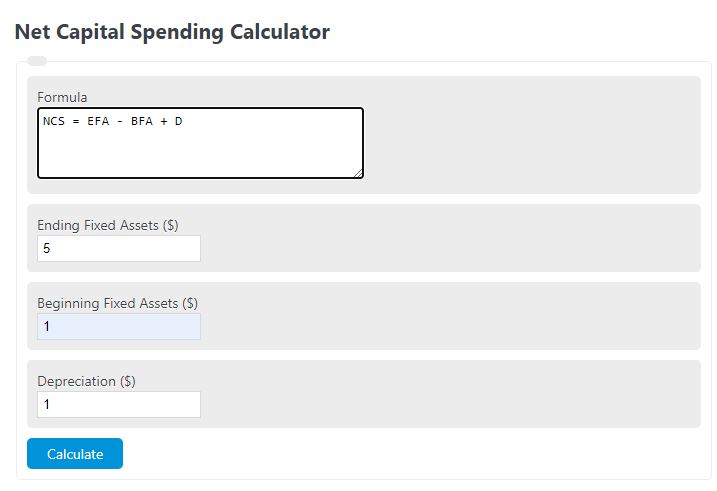

Enter the ending fixed assets, beginning fixed, and total depreciation into the calculator to determine the net capital spending.

- Capital Expenditure (CapEx) Calculator

- Invested Capital Calculator

- Capital Gains Yield Calculator + Formula

- Change in Net Working Capital Calculator

- Capital Charge Factor Calculator

Net Capital Spending Formula

The following formula is used to calculate net capital spending.

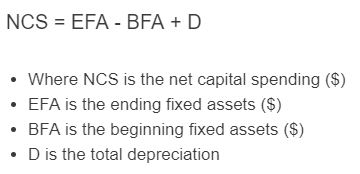

NCS = EFA - BFA + D

- Where NCS is the net capital spending ($)

- EFA is the ending fixed assets ($)

- BFA is the beginning fixed assets ($)

- D is the total depreciation

To calculate the net capital spending, subtract the beginning fixed assets value from the ending value, then add the total depreciation.

Net Capital Spending Definition

Net capital spending is defined as the fixed asset values minus the depreciation.

Net Capital Spending Example

How to calculate net capital spending?

- First, determine the beginning fixed assets.

Sum the value of all fixed assets at the beginning period. For this example, we will say this is $10,000.00.

- Next, determine the ending fixed assets.

Determine the value of all assets at the end of the time period. For this example we find the value to be $15,000.00

- Next, determine the depreciation.

Find the depreciation of the assets over the same time. We will assume this is $1,000.00.

- Finally, calculate the net capital spend.

Using the formula above we find the net capital spending is $15,000.00-$10,000.00+$1,000.00 = $6,000.00

FAQ

Net capital spending is the total amount of capital spent after depreciation.