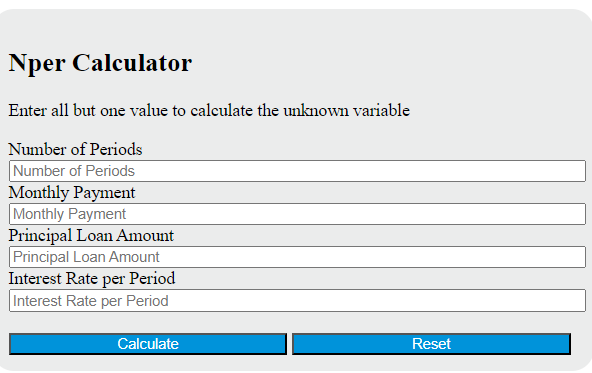

Enter all but one of the Nper, MP, P, r, and n into the Nper Calculator to determine the remaining variable, where n is equal to the logarithm of ((MP divided by (MP minus P multiplied by r)) divided by (r plus 1)) to the base of (r plus 1).

Nper Formula

n = log((MP / (MP - P * r)) / (r + 1), (r + 1))

What is a Nper?

Nper, short for Number of Periods, is a financial function used to calculate the total number of payment periods for an investment or a loan. This function is commonly used in financial modeling and analysis, where it helps in determining the duration required to pay off a loan or reach an investment goal. The Nper function requires three arguments: rate (the interest rate for each period), pmt (the payment made each period), and pv (the present value or total amount of all payments made in the future). It may also include two optional arguments: fv (the future value or desired balance after the last payment has been made) and type (indicating when payments are due).

How to Calculate Nper?

The following steps outline how to calculate the Nper:

- First, determine the interest rate per period (%).

- Next, determine the payment per period ($).

- Next, determine the present value ($).

- Finally, calculate the Nper.

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem:

Use the following variables as an example problem to test your knowledge.

interest rate per period (%) = 5

payment per period ($) = 100

present value ($) = 1000