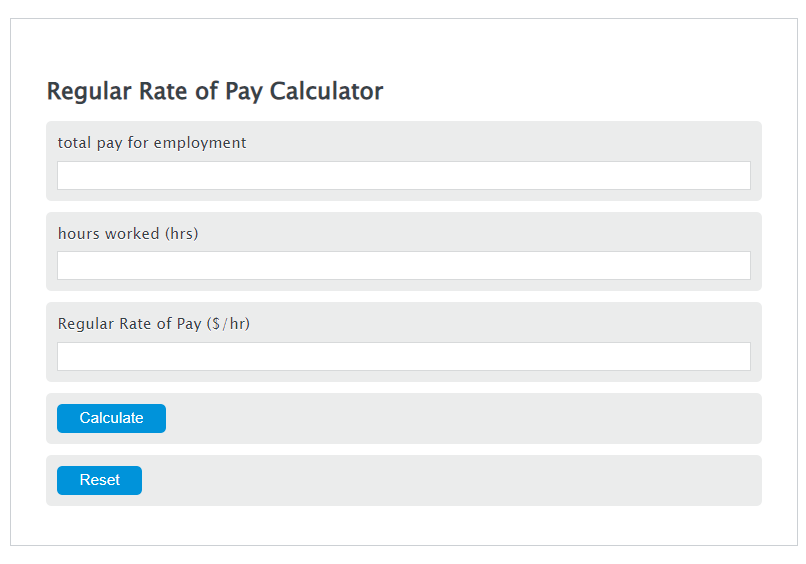

Enter the total pay for employment and the hours worked (hrs) into the Calculator. The calculator will evaluate the Regular Rate of Pay.

Regular Rate of Pay Formula

RRP = TPE / HW

Variables:

- RRP is the Regular Rate of Pay ($/hr)

- TPE is the total pay for employment

- HW is the hours worked (hrs)

To calculate the Regular Rate of Pay, divide the total pay for employment by the hours of work performed.

How to Calculate the Regular Rate of Pay?

The following steps outline how to calculate the Regular Rate of Pay.

- First, determine the total pay for employment.

- Next, determine the hours actually worked (hrs).

- Next, gather the formula from above = RRP = TPE / HW.

- Finally, calculate the Regular Rate of Pay.

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem :

Use the following variables as an example problem to test your knowledge.

total pay for employment = 1000

hours actually worked (hrs) = 20

Frequently Asked Questions

What is the Regular Rate of Pay?

The Regular Rate of Pay is the hourly rate calculated by dividing the total pay for employment by the total hours worked. It is expressed in dollars per hour ($/hr).

Why is calculating the Regular Rate of Pay important?

Calculating the Regular Rate of Pay is crucial for ensuring compliance with labor laws, accurately compensating employees for overtime, and managing payroll effectively.

Can the Regular Rate of Pay include bonuses or commissions?

Yes, the Regular Rate of Pay can include non-discretionary bonuses, commissions, and other forms of compensation that are part of the total pay for employment, affecting the calculation.

How does overtime pay affect the Regular Rate of Pay?

Overtime pay is typically calculated based on the Regular Rate of Pay. In many jurisdictions, employees are entitled to a higher rate (e.g., 1.5 times the Regular Rate of Pay) for hours worked beyond the standard workweek.