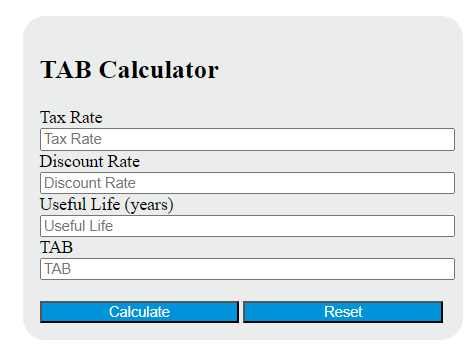

Enter the tax rate, discount rate, and useful life of the asset into the calculator to determine the Tax Amortisation Benefit Factor.

Tab (Tax Amortisation Benefit Factor) Formula

The following formula is used to calculate the Tax Amortisation Benefit (TAB) Factor.

TAB = (T * r * (1 - (1 + r)^-n)) / r

Variables:

- TAB is the Tax Amortisation Benefit Factor

- T is the tax rate

- r is the discount rate

- n is the useful life of the asset in years

To calculate the Tax Amortisation Benefit Factor, multiply the tax rate by the discount rate. Subtract the result of 1 plus the discount rate raised to the power of the negative useful life of the asset from 1. Multiply the first result by the second result. Finally, divide the result by the discount rate.

What is a Tab (Tax Amortisation Benefit Factor)?

A Tax Amortisation Benefit (TAB) factor is a financial concept that refers to the present value of the tax shield provided by the amortisation of an intangible asset. It is used in business valuation to account for the tax benefits a company receives from the depreciation of its intangible assets, such as patents, trademarks, or copyrights. The TAB factor can increase the value of a company’s intangible assets, thus increasing the overall value of the company.

How to Calculate Tab (Tax Amortisation Benefit Factor)?

The following steps outline how to calculate the Tax Amortisation Benefit Factor (TAB).

- First, determine the tax rate (T).

- Next, determine the discount rate (r).

- Next, determine the useful life of the asset in years (n).

- Next, gather the formula from above = TAB = (T * r * (1 – (1 + r)^-n)) / r.

- Finally, calculate the Tax Amortisation Benefit Factor (TAB).

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem:

Use the following variables as an example problem to test your knowledge.

tax rate (T) = 0.25

discount rate (r) = 0.05

useful life of the asset in years (n) = 10