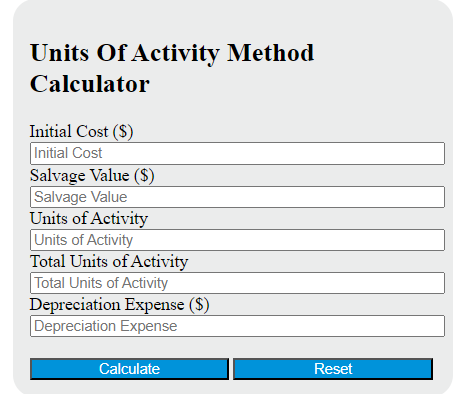

Enter the initial cost of the asset, salvage value, units of activity for the current period, and total units of activity over the asset’s useful life into the calculator to determine the depreciation expense.

- Accumulated Depreciation Calculator

- Reverse Depreciation Calculator

- Double Declining Depreciation Calculator

- Units of Production Depreciation Calculator

Units Of Activity Method Formula

The following formula is used to calculate the depreciation expense using the Units of Activity Method. Variables:

DE = (C - SV) * (UA / TUA)

- DE is the depreciation expense ($)

- C is the initial cost of the asset ($)

- SV is the salvage value of the asset ($)

- UA is the units of activity for the current period

- TUA is the total units of activity over the asset’s useful life

To calculate the depreciation expense, subtract the salvage value of the asset from the initial cost. Then, divide the units of activity for the current period by the total units of activity over the asset’s useful life. Multiply these two results to get the depreciation expense.

What is a Units Of Activity Method?

The Units of Activity Method, also known as the Units of Production Method, is a depreciation method that calculates the depreciation expense of an asset based on its actual usage or production output. Instead of evenly spreading the cost of the asset over its useful life, like the straight-line method, this method allocates the cost based on the asset’s activity, such as the number of units it produces or the hours it operates. This method is particularly useful for assets whose wear and tear is more closely related to their usage rather than their age.

How to Calculate Units Of Activity Method?

The following steps outline how to calculate the Depreciation Expense using the Units Of Activity Method.

- First, determine the initial cost of the asset ($).

- Next, determine the salvage value of the asset ($).

- Next, determine the units of activity for the current period.

- Next, determine the total units of activity over the asset’s useful life.

- Next, gather the formula from above = DE = (C – SV) * (UA / TUA).

- Finally, calculate the Depreciation Expense.

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem :

Use the following variables as an example problem to test your knowledge.

initial cost of the asset ($) = 5000

salvage value of the asset ($) = 1000

units of activity for the current period = 100

total units of activity over the asset’s useful life = 1000