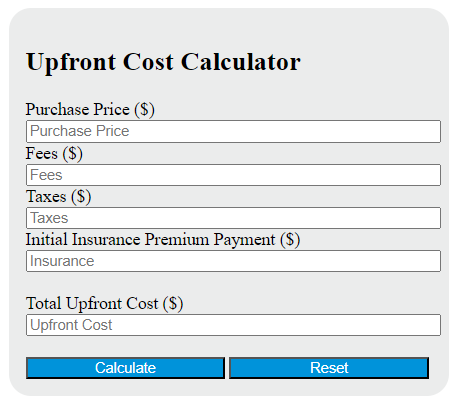

Enter the purchase price of the property, the fees associated with the purchase, the taxes due at the time of purchase, and the initial insurance premium payment into the calculator to determine the total upfront cost.

Upfront Cost Formula

The following formula is used to calculate the upfront cost.

UC = (P + F + T + I)

Variables:

- UC is the total upfront cost ($)

- P is the purchase price of the property ($)

- F is the fees associated with the purchase (e.g., legal fees, inspection fees) ($)

- T is the taxes due at the time of purchase ($)

- I is the initial insurance premium payment ($)

To calculate the total upfront cost, add together the purchase price of the property, the fees associated with the purchase, the taxes due at the time of purchase, and the initial insurance premium payment.

What is an Upfront Cost?

An upfront cost is an initial investment or payment made before receiving a good, service, or starting a project. It is often required to cover the initial expenses of a transaction, such as production costs, setup fees, or equipment purchases. This cost is usually non-refundable and is paid before any benefits or returns are realized from the investment or purchase.

How to Calculate Upfront Cost?

The following steps outline how to calculate the Upfront Cost.

- First, determine the purchase price of the property ($).

- Next, determine the fees associated with the purchase ($).

- Next, determine the taxes due at the time of purchase ($).

- Next, determine the initial insurance premium payment ($).

- Finally, use the formula UC = (P + F + T + I) to calculate the total upfront cost.

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem :

Use the following variables as an example problem to test your knowledge.

purchase price of the property ($) = 200,000

fees associated with the purchase ($) = 5,000

taxes due at the time of purchase ($) = 10,000

initial insurance premium payment ($) = 2,000