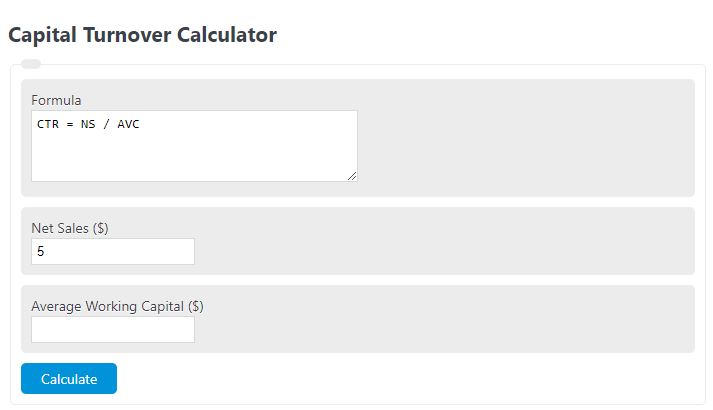

Enter the total annual sales of a business and the total amount of stockholders’ equity into the calculator to determine the capital turnover.

Capital Turnover Formula

The following formula is used to calculate a working capital turnover ratio,

CTR = NS / SE

- Where CTR is the capital turnover ratio

- NS is the annual net sales ($)

- SE is the stockholders’ equity ($)

Capital Turnover Definition

Capital turnover is a financial ratio used to measure how efficiently a company utilizes its capital to generate revenue. It is calculated by dividing a company’s net sales or revenue by its average total assets. The ratio provides insights into how effectively a company utilizes its assets to generate sales.

A high capital turnover ratio indicates that a company is generating a significant amount of revenue relative to its asset investment. This suggests that the company is efficiently utilizing its capital to generate sales. On the other hand, a low capital turnover ratio suggests that a company is not effectively utilizing its assets to generate revenue. This could be due to a variety of factors, such as underutilization of assets or inefficient business practices.

Capital turnover is particularly useful for comparing companies within the same industry or sector. It allows investors and analysts to assess how well a company is utilizing its assets relative to its peers. It can also be used to track a company’s performance over time and identify trends in asset utilization.

However, it is important to note that capital turnover should not be considered in isolation. It should be analyzed in conjunction with other financial ratios and factors, such as profitability, liquidity, and solvency, to get a comprehensive understanding of a company’s financial health and performance.

What is a good capital turnover ratio?

A good capital turnover ratio depends on the type of company. For service or software base companies, assets are very low while net sales can be high, so their capital turnover ratio will be very high. For a sector such as car manufacturing, the value of assets is much higher, so the stockholders will invest much more equity for the same amount of sales.

What does capital turnover represent?

At its core, a capital turnover is calculated to try and represent and understand the amount of stockholders’ equity that needs to be invested into a business to generate net positive sales. Companies specializing in software as a service have very high capital turnovers because the equity required to start is extremely low.

A capital turnover can also be used to understand the value of an investment. The higher the turnover, the greater the potential investment. This is only one metric, so it should be combined with other information.

Why is capital turnover important?

Capital turnover is an important metric in valuing a business or business prospect, but it has flaws.

For example, suppose a company takes out loans to generate additional sales instead of issuing more equity. In that case, the capital turnover will increase, but the company’s risk will also increase because of the high leverage.

Another limitation of capital turnover is that it only considers net sales. It does not consider profit, often considered the more important metric.

Capital Turnover Example

How to calculate capital turnover ratio?

- First, determine the net sales.

Over a given period of time, calculate the total net sales revenue generated. For this example, the net sales were $10,000.00

- Next, determine the total stockholders’ equity.

Over the same time period, calculate the total amount of stockholders’ equity. For this example, the equity issued was $5,000.00.

- Finally, calculate the capital turnover.

Use the formula above to calculate the capital turnover. So, $10,000.00/$5,000.00 = 2.

FAQ

Capital turnover is a ratio of the total annual sales of a business compared with the total amount of its stockholders’ equity.