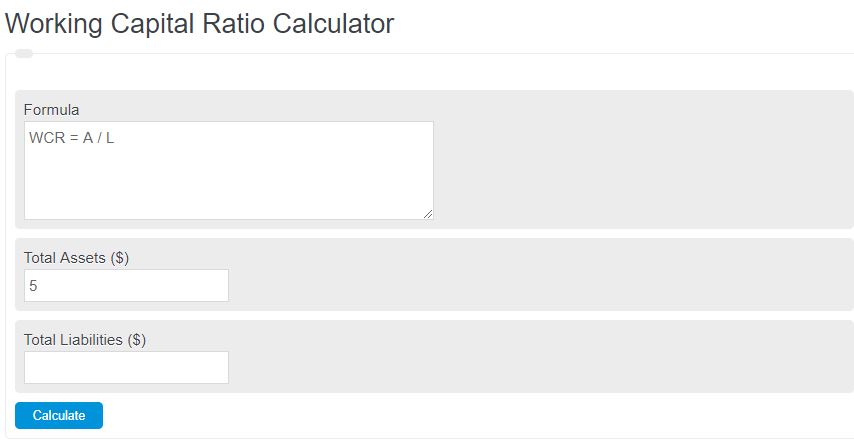

Enter the current assets and current liabilities into the calculator to determine the working capital ratio of a business.

- Current Ratio Calculator

- Capital Gains Yield Calculator + Formula

- Solvency Ratio Calculator

- Net Capital Spending Calculator

Working Capital Ratio Formula

The following formula is used to calculate a working capital ratio.

WCR = A / L

- Where WCR is the working capital ratio

- A is the total assets ($)

- L is the total liabilities ($)

Working Capital Ratio Definition

The Working Capital Ratio is a financial metric that measures a company’s ability to cover its short-term liabilities using its current assets. It is calculated by dividing the current assets by the current liabilities.

The current assets include cash, accounts receivable, inventory, and other assets expected to be converted into cash within one year.

Current liabilities include accounts payable, short-term debt, and other obligations due within one year.

This ratio is crucial as it provides insights into a company’s liquidity and financial health. It indicates the company’s ability to meet its short-term obligations without relying on additional external financing.

A higher working capital ratio suggests that a company has enough current assets to cover its liabilities, indicating a sound financial position.

A working capital ratio above 1 indicates that a company has more current assets than current liabilities, indicating a strong ability to meet short-term obligations.

A ratio below 1 implies that a company may struggle to pay off its short-term debts and may face liquidity issues.

Working Capital Ratio Example

How to calculate a working capital ratio?

- First, determine the total asset value.

Measure the value of all assets owned by the business.

- Next, determine the total liabilities value.

Measure the total value of all liabilities owned by the business.

- Finally, calculate the working capital ratio.

Calculate the working capital ratio using the equation above.

FAQ

What factors can affect a company’s working capital ratio?

A company’s working capital ratio can be influenced by several factors including changes in current assets such as inventory levels, accounts receivable, and cash holdings, as well as variations in current liabilities like accounts payable and short-term debt. Operational efficiency, sales cycles, and the timing of asset purchases and liability payments can also impact the ratio.

Why is a working capital ratio above 1 considered healthy?

A working capital ratio above 1 is considered healthy because it indicates that a company has more current assets than current liabilities, suggesting that it can meet its short-term obligations without needing additional financing. This shows that the company is in a solid financial position to cover its operational expenses and has a buffer to handle unexpected financial challenges.

Can a very high working capital ratio be a bad sign?

Yes, while a higher working capital ratio generally indicates financial health, an excessively high ratio may suggest that a company is not efficiently using its assets to grow or expand its operations. It might indicate excessive inventory, underutilization of assets, or a reluctance to invest in profitable ventures, potentially signaling operational inefficiencies or overly conservative financial management.

How can a company improve its working capital ratio?

A company can improve its working capital ratio by managing its current assets and liabilities more efficiently. This might involve speeding up the collection of receivables, optimizing inventory levels, negotiating longer payment terms with suppliers, or refinancing short-term debt into longer-term obligations. Improving operational efficiencies to increase cash flow can also positively impact the working capital ratio.