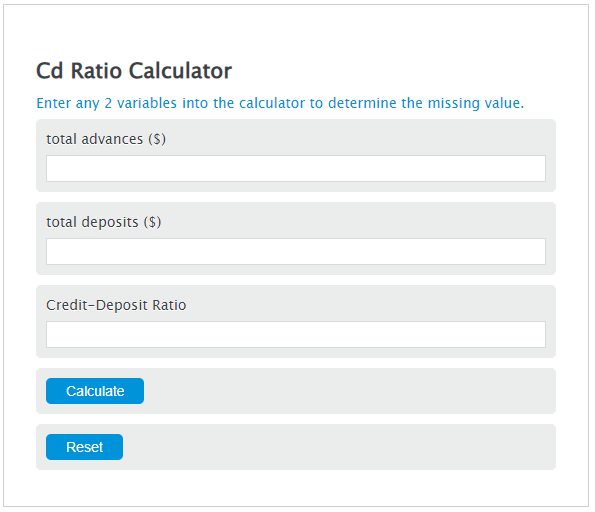

Enter the total advances ($) and the total deposits ($) into the Calculator. The calculator will evaluate the Credit-Deposit Ratio.

Credit-Deposit Ratio Formula

CDR = TA / TD

Variables:

- CDR is the Credit-Deposit Ratio

- TA is the total advances ($)

- TD is the total deposits ($)

To calculate Credit-Deposit Ratio, divide the total advances by the total deposits.

How to Calculate Credit-Deposit Ratio?

The following steps outline how to calculate the Credit-Deposit Ratio.

- First, determine the total advances ($).

- Next, determine the total deposits ($).

- Next, gather the formula from above = CDR = TA / TD

- Finally, calculate the Credit-Deposit Ratio.

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem :

Use the following variables as an example problem to test your knowledge.

total advances ($) = 15000

total deposits ($) = 20000

Frequently Asked Questions (FAQ)

What is the significance of the Credit-Deposit Ratio in the banking sector?

The Credit-Deposit Ratio (CDR) is a key indicator used by banks to assess their liquidity and efficiency in lending. A higher CDR suggests that a bank is making more advances relative to its deposits, which could indicate higher profitability but also higher risk. Conversely, a lower CDR can imply more conservative lending practices and potentially greater liquidity.

How does the Credit-Deposit Ratio affect consumers?

The Credit-Deposit Ratio can impact consumers by influencing the interest rates on loans and deposits. Banks with higher CDRs might offer higher interest rates on deposits to attract more funds, while also possibly charging higher rates on loans to mitigate the risk of their lending activities. This ratio helps consumers assess the risk and return profile of banking with a particular institution.

Can the Credit-Deposit Ratio influence a bank’s monetary policy?

Yes, the Credit-Deposit Ratio can influence a bank’s monetary policy decisions. Central banks may monitor the CDR of commercial banks to gauge the overall credit market conditions and adjust their monetary policy tools, such as interest rates and reserve requirements, accordingly to ensure economic stability and control inflation.

Is there an ideal Credit-Deposit Ratio that banks aim for?

There isn’t a universally ideal Credit-Deposit Ratio as it varies depending on the bank’s business model, risk appetite, and the economic conditions. However, banks strive to maintain a balanced CDR that optimizes their profit while minimizing risk and ensuring sufficient liquidity to meet withdrawal demands.