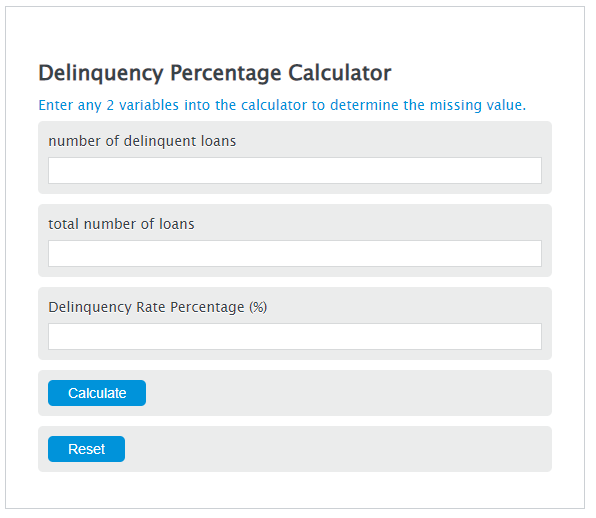

Enter the number of delinquent loans and the total number of loans into the Calculator. The calculator will evaluate the Delinquency Rate Percentage.

Delinquency Rate Percentage Formula

DP = DL / TL * 100

Variables:

- DP is the Delinquency Rate Percentage (%)

- DL is the number of delinquent loans

- TL is the total number of loans

To calculate the Delinquency Rate Percentage, divide the number of delinquent loans by the total number of loans, then multiply by 100.

How to Calculate Delinquency Rate Percentage?

The following steps outline how to calculate the Delinquency Rate Percentage.

- First, determine the number of delinquent loans.

- Next, determine the total number of loans.

- Next, gather the formula from above = DP = DL / TL * 100.

- Finally, calculate the Delinquency Rate Percentage.

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem :

Use the following variables as an example problem to test your knowledge.

number of delinquent loans = 1900

total number of loans = 250000

Frequently Asked Questions (FAQ)

What is a delinquent loan?

A delinquent loan is a loan on which a borrower is late or has missed payments. Typically, a loan is considered delinquent when a payment is 30 days overdue.

Why is it important to calculate the Delinquency Rate Percentage?

Calculating the Delinquency Rate Percentage helps financial institutions and investors understand the risk level of a loan portfolio. A higher rate indicates more borrowers are failing to make timely payments, which can signal financial instability.

Can the Delinquency Rate Percentage affect a borrower’s credit score?

Yes, delinquent loans can significantly affect a borrower’s credit score. Late payments are reported to credit bureaus, and the longer a loan remains delinquent, the more it can harm a borrower’s credit rating.

How can borrowers avoid loan delinquency?

Borrowers can avoid loan delinquency by setting up automatic payments, keeping track of due dates, and contacting lenders for assistance or to negotiate payment plans if they anticipate difficulty in making timely payments.