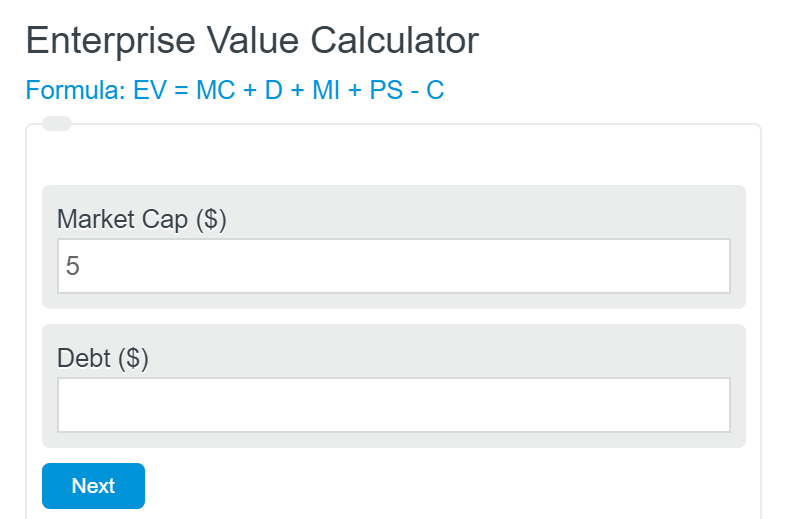

Enter the market capitalization, minority interest, preferred shares, value of debt, and cash to calculate the enterprise value.

- Ear Calculator

- Growth Rate Calculator

- Earnings Per Share Calculator

- Free Cash Flow Calculator

- Market Capitalization Calculator

Enterprise Value Formula

The following formula is used to calculate the enterprise value of a company.

EV = MC + D + MI + PS - C

- Where EV is the enterprise value

- Enterprise value is a measure of the total value of a company with respect to the values above

- MC is the market cap

- Market Capitalization is the value of all of the outstanding shares of a company

- D is the debt

- debt is the amount of outstanding monetary commitments

- MI is the minority interest

- equity owned by an investor or company with less than 50% interest

- PS is the preferred shares

- stocks that have a claim to a companies assets

- C is the cash

- cash and cash equivalents

Enterprise Value Definition

Enterprise value is a financial term used to describe the value of a company based on market cap, debt, minority interest, preferred shares, and cash.

How to calculate Enterprise Value?

How to calculate enterprise value?

- First, determine the market cap.

Calculate the total market capitalization of the company.

- Next, determine the total debt.

Measure the total debt owned by the company.

- Next, determine the minority interest.

Calculate the equity owned by the minority investors.

- Next, determine the preferred shares.

Measure the total number of preferred shares.

- Next, determine the cash.

Measure the cash and cash equivalents owned by the company.

- Finally, calculate the enterprise value.

Using the formula above, calculate the enterprise value.

FAQ

Enterprise value is a measure of the value of a company that goes further than just the market cap since it takes into account debt and other factors. It’s typically a better indicator of the “true” value of a company.

Enterprise value is typically used in the finance sector for determining good investments.

Simply use the calculator above.