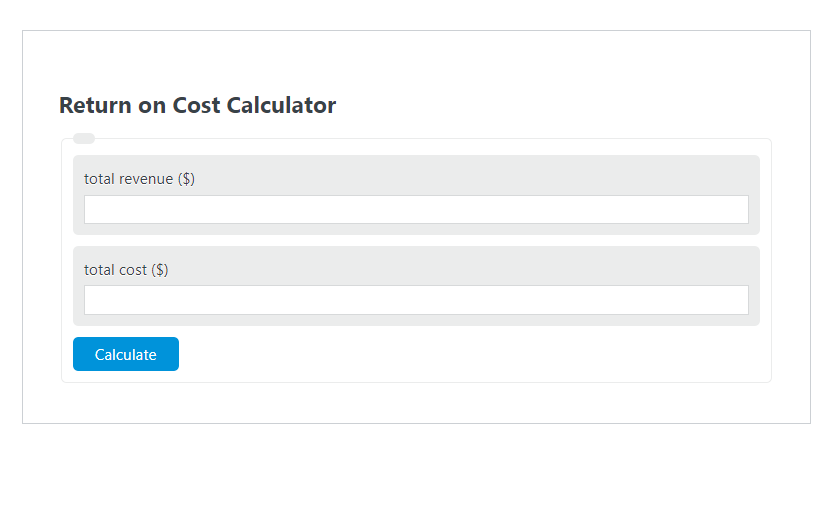

Enter the total revenue ($) and the total cost ($) into the Return on Cost Calculator. The calculator will evaluate and display the Return on Cost.

- Return on “X” Calculators

- Return on Hedge Funds Calculator

- Return on Inventory Calculator

- Return on Common Equity Calculator

Return on Cost Formula

The following formula is used to calculate the Return on Cost.

ROC = (TR - TC) / TC * 100

- Where ROC is the Return on Cost (%)

- TR is the total revenue ($)

- TC is the total cost ($)

To calculate the return on cost, subtract the cost from the revenue, divide by the cost, then multiply by 100.

How to Calculate Return on Cost?

The following example problems outline how to calculate Return on Cost.

Example Problem #1:

- First, determine the total revenue ($).

- The total revenue ($) is given as: 675.

- Next, determine the total cost ($).

- The total cost ($) is provided as: 500.

- Finally, calculate the Return on Cost using the equation above:

ROC = (TR – TC) / TC * 100

The values given above are inserted into the equation below and the solution is calculated:

ROC = (675 – 500) / 500 * 100 = 35 (%)

FAQ

What is Return on Cost (ROC) and why is it important?

ROC measures the profitability and efficiency of an investment by comparing the gain (or loss) from an investment relative to its cost. It’s important because it helps investors and businesses evaluate the performance of their investments, guiding them in making informed decisions about where to allocate resources.

Can Return on Cost be negative, and what does that indicate?

Yes, the Return on Cost can be negative if the total costs exceed the total revenues. This indicates that the investment is losing money rather than generating a profit, signaling that the business or investor may need to reassess their investment or find ways to reduce costs or increase revenue.

How does Return on Cost differ from Return on Investment (ROI)?

While both metrics are used to evaluate the efficiency of an investment, Return on Cost specifically looks at the profit generated from the cost of the investment, whereas Return on Investment (ROI) considers the return relative to the investment’s initial cost. ROC is often used for projects or investments where the cost is a significant factor, while ROI is a more general measure of profitability.