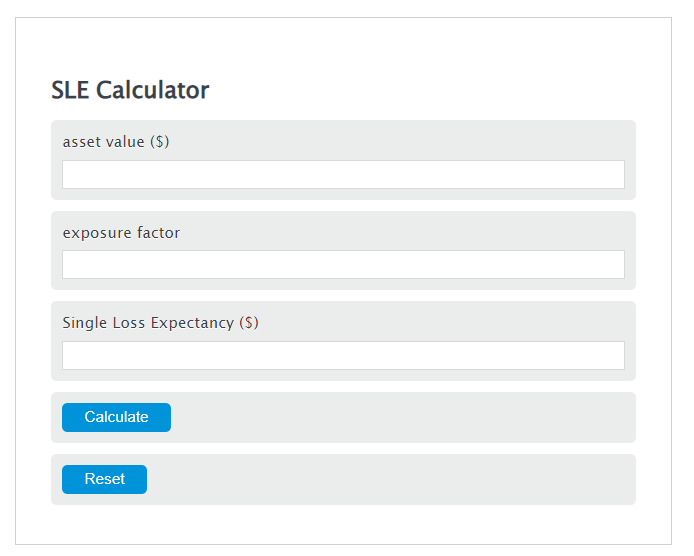

Enter the asset value ($) and the exposure factor into the Calculator. The calculator will evaluate the Single Loss Expectancy.

Single Loss Expectancy Formula

SLE = AV * EF

Variables:

- SLE is the Single Loss Expectancy ($)

- AV is the asset value ($)

- EF is the exposure factor

To calculate Single Loss Expectancy, multiply the asset value by the exposure factor.

How to Calculate Single Loss Expectancy?

The following steps outline how to calculate the Single Loss Expectancy.

- First, determine the asset value ($).

- Next, determine the exposure factor.

- Next, gather the formula from above = SLE = AV * EF.

- Finally, calculate the Single Loss Expectancy.

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem :

Use the following variables as an example problem to test your knowledge.

asset value ($) = 500,000

exposure factor = 0.75

FAQ

What is Single Loss Expectancy (SLE) in risk management?

Single Loss Expectancy is a concept in risk management used to estimate the monetary loss associated with a single risk event. It is calculated by multiplying the asset value by the exposure factor, representing the potential financial impact of a risk on an asset.

How important is understanding the exposure factor in calculating SLE?

The exposure factor is crucial in calculating SLE as it represents the percentage of loss an asset would suffer from a risk event. Understanding the exposure factor helps in accurately assessing the potential financial impact and in making informed decisions to mitigate risks.

Can Single Loss Expectancy be applied to all types of assets?

Yes, SLE can be applied to various types of assets, including physical assets like buildings and equipment, as well as intangible assets like data and intellectual property. It is a versatile metric used across different industries to assess financial risk exposure.

What are some common methods to reduce Single Loss Expectancy?

To reduce Single Loss Expectancy, organizations can implement risk mitigation strategies such as improving security measures, purchasing insurance, implementing redundancy systems, and conducting regular risk assessments to identify and address vulnerabilities.