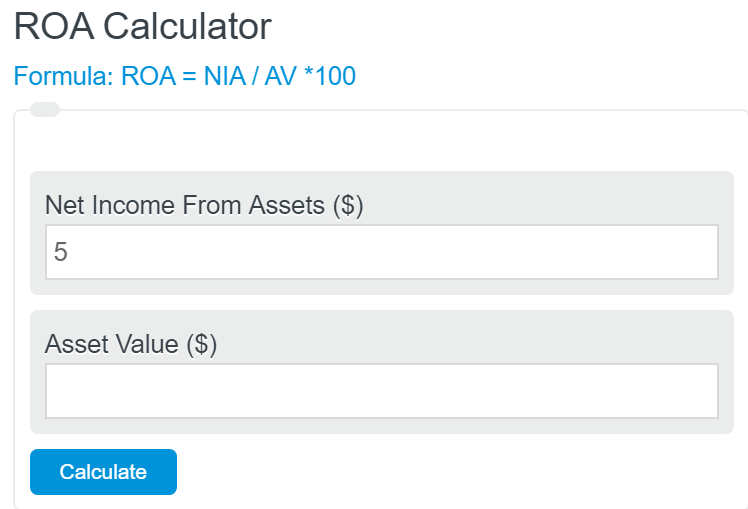

Enter the total net income from assets and the total value of those assets into the return on assets calculator. The calculator will show the ROA in dollars and percentages.

- Return on “X” Calculators

- Quick Ratio Calculator

- Markdown Calculator

- Return on Equity Calculator

- Net Fixed Assets Calculator

Return on Assets Formula

The following formula is used to calculate the ROA.

ROA = NIA / AV *100

- Where ROA is the return on assets (%)

- NIA is the net income from assets

- AV is the asset value

To calculate the return on assets, divide the net income from assets by the asset value, then multiply by 100.

ROA Definition

ROA, short for return on assets, is a measure of the total monetary return or growth an asset has generated over time.

How to calculate ROA?

How to calculate ROA?

- First, determine the value of the assets

The first step in calculating the ROA is determining the value of the assets. Since ROA is a ratio of asset value to income from assets, it’s important to value only the assets generating the income.

- Second, determine the net income

This will be the net income those assets are generating. Typically this falls in terms of sales or rent if you are talking about

- Last, calculate the ROA

Use the formula above to calculate the return on assets.

FAQ

ROA stands for return on assets. This is a measure of the percent “return” assets provide. In other words, how much income an asset generates vs the cost.

The answer to this question entirely depends on the type of asset. For example, a real estate asset like a rental home usually yields lower ROA, but the asset itself also grows in value over time, which is not considered in this equation.

The answer to this could be multi-faceted, but to keep it short, we’ll give one solution. Reduce the operating expense of the asset. This will increase net profit and income, and increase the ROA.